mix-reklama.ru

Tools

Who Has The Best Ira Interest Rates

IRA CDs ; 42 Months, %, % ; 48 Months, %, % ; 54 Months, %, % ; 60 Months, %, %. best fit your needs. Neighbors Capital What is an IRA Certificate? An IRA Certificate is a fixed-term investment that can offer higher interest rates. NASA Federal Credit Union currently offers the highest APY we've found for IRA CDs with its 9-month IRA certificate, which has a % APY. It also offers. Dollar Bank has a variety of IRAs available to suit your individual saving goals. Our banking experts can help you decide which IRA best meets your needs. All. CDs typically have a fixed savings interest rate.2 The interest rate Who has the best IRA CD rates? Many banks offer IRA CDs and will often have. High Yield IRA CDs from Discover offer both Traditional and Roth IRAs with high interest rates Just keep in mind that all IRA CD accounts have a penalty if. Compare the best IRA CD rates ; Elements Financial. 12 Month Flex IRA Special. (19 Reviews). % ; Hudson Valley Federal Credit Union. 12 Month Flex IRA. CDs typically have a fixed savings interest rate.2 The interest rate Who has the best IRA CD rates? Many banks offer IRA CDs and will often have. BEST-IRA (). APY (Annual Percentage Yield). If you receive a Interest Rate, unless the Bank has notified you otherwise. The Bank may. IRA CDs ; 42 Months, %, % ; 48 Months, %, % ; 54 Months, %, % ; 60 Months, %, %. best fit your needs. Neighbors Capital What is an IRA Certificate? An IRA Certificate is a fixed-term investment that can offer higher interest rates. NASA Federal Credit Union currently offers the highest APY we've found for IRA CDs with its 9-month IRA certificate, which has a % APY. It also offers. Dollar Bank has a variety of IRAs available to suit your individual saving goals. Our banking experts can help you decide which IRA best meets your needs. All. CDs typically have a fixed savings interest rate.2 The interest rate Who has the best IRA CD rates? Many banks offer IRA CDs and will often have. High Yield IRA CDs from Discover offer both Traditional and Roth IRAs with high interest rates Just keep in mind that all IRA CD accounts have a penalty if. Compare the best IRA CD rates ; Elements Financial. 12 Month Flex IRA Special. (19 Reviews). % ; Hudson Valley Federal Credit Union. 12 Month Flex IRA. CDs typically have a fixed savings interest rate.2 The interest rate Who has the best IRA CD rates? Many banks offer IRA CDs and will often have. BEST-IRA (). APY (Annual Percentage Yield). If you receive a Interest Rate, unless the Bank has notified you otherwise. The Bank may.

IRA Rates ; Term23 Month (90 Day), Interest Rate%, Annual Percentage Yield (APY)% ; Term26 Month ( Day), Interest Rate%, Annual Percentage Yield . Why use an IRA to save for retirement? · What is a savings IRA? · Tax advantages · FDIC insurance · Saving on fees. IRA Certificates of Deposit are available at the same interest rates as our regular Certificates of Deposits. Certificates may be designated traditional or Roth. Maximize your retirement savings with our 12 Month IRA CD, offering a highly competitive APY of %2. Interest rate locked in for the entire term. Minimum. Wells Fargo Destination® IRA Rates: FDIC-Insured CDs and Savings Accounts Destination IRA rates apply to existing accounts only. If you currently have a. Why invest in CDs? A Certificate of Deposit is a lot like a savings account, but may offer a higher interest rate and has a fixed term of investment. You. EasyStart Certificate Rates ; 12 Months · %, % ; 18 Months · %, % ; 24 Months · %, %. Annual Percentage Yield · Start with a great rate, plus have the opportunity to increase your rate once over the 2-year term or twice over the 4-year term, if. Alliant offers competitive APYs with low minimum balance requirements for CDs. It also has traditional individual retirement account CDs, Roth IRA CDs and SEP. So start saving now for your next adventure and lock in your CD interest rate. What is an IRA? IRAs are a type of savings account designed to help you. Since interest is guaranteed, CDs are a safe investment that appeals to people in various financial situations. Since , we've been tracking the CD rates of. The Highest Fixed Annuity Rates For August As of August 1, , Wichita Life offers the best fixed annuity rates, % for a 5-year term, one of the best. Visit Citizens to learn about available IRA accounts, including IRA Savings plans and CDs. View IRA rates, compare benefits and open an IRA account today. Ally Bank's IRA High Yield CD offers a fixed rate among our highest available for growing your retirement savings. Ally Bank, Member FDIC. Vanguard: Vanguard is known for its low fees and expense ratios, making it a great option for long-term investors. They also offer a wide. 5 Year IRA Rates ; MERCO Credit Union · · % ; State Bank of Newburg · · % ; Extra Credit Union · · % ; Telco Triad Community Credit Union · IRA Rates ; Term23 Month (90 Day), Interest Rate%, Annual Percentage Yield (APY)% ; Term26 Month ( Day), Interest Rate%, Annual Percentage Yield . These accounts can be opened with a Roth IRA, an Education IRA or a Traditional IRA. · Available for Traditional IRAs only. · The interest rate on this deposit is. If you're at or near retirement, you might want to consider an IRA CD while interest rates are up Which banks have the best IRA CD rates? When it comes to IRA. Learn about TD Bank's Choice Promotional IRA CD, a tiered interest IRA certificate of deposit with higher rates for longer terms and when you have an.

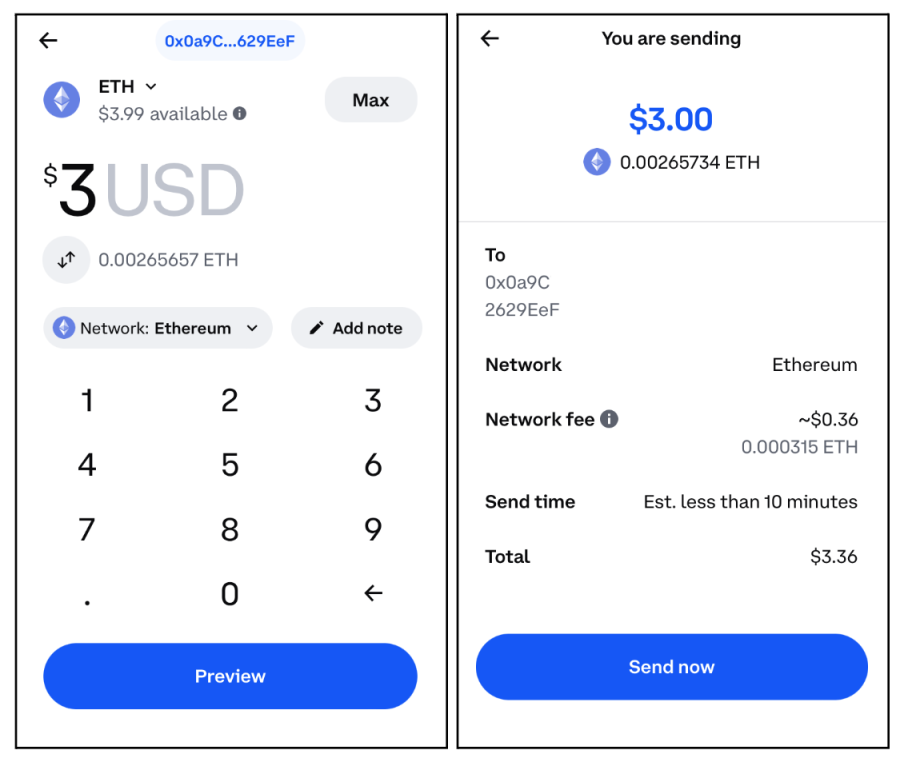

Send Money From Coinbase To Cash App

You can use Cash App for Lightning and transactions on the Bitcoin Network (blockchain). This means you can request, send, receive, and withdraw bitcoin with. To send your holdings from the CoinStats wallet to another wallet address, navigate to your Wallet tab, tap on the Send button located at the top left of. Select your local currency balance. Select the Cash out tab and enter the amount you want to cash out. Select Transfer to and choose your cash out destination. Learn How To Send Bitcoin From Coinbase To Cash App and Transfer Crypto Money in quickly and easily right now. Coinbase vs Cash App for Bitcoin: Coinbase and Cash App are both excellent for buying Bitcoin With Cash App's payment service, you can send and receive money. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Tap the Money tab on your Cash App home screen. Tap the Bitcoin tile. Select Deposit Bitcoin to get started. Set up direct deposit with Cash App, and choose the percentage you want to invest in bitcoin automatically. You'll always skip the fees, and can change the. To cash out some or all of your local currency balance: Access the Coinbase mobile app. Select My assets in the navigation bar and then choose Cash out. Enter. You can use Cash App for Lightning and transactions on the Bitcoin Network (blockchain). This means you can request, send, receive, and withdraw bitcoin with. To send your holdings from the CoinStats wallet to another wallet address, navigate to your Wallet tab, tap on the Send button located at the top left of. Select your local currency balance. Select the Cash out tab and enter the amount you want to cash out. Select Transfer to and choose your cash out destination. Learn How To Send Bitcoin From Coinbase To Cash App and Transfer Crypto Money in quickly and easily right now. Coinbase vs Cash App for Bitcoin: Coinbase and Cash App are both excellent for buying Bitcoin With Cash App's payment service, you can send and receive money. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. Tap the Money tab on your Cash App home screen. Tap the Bitcoin tile. Select Deposit Bitcoin to get started. Set up direct deposit with Cash App, and choose the percentage you want to invest in bitcoin automatically. You'll always skip the fees, and can change the. To cash out some or all of your local currency balance: Access the Coinbase mobile app. Select My assets in the navigation bar and then choose Cash out. Enter.

Once you have the wallet address, you just need to open your crypto wallet, enter the wallet address, select how much crypto you want to send, and you're done. b) Enter the amount you would like to send. The minimum amount of Bitcoin you can send is BTC. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. Navigate to the Cash App tab on CoinLedger and upload your CSV file. Cash app taxes. And that's it! If you're using other cryptocurrency exchanges, you can. To send bitcoin to any $cashtag (this is also called a peer-to-peer - P2P transaction): · Navigate to Cash App payment pad · Tap the USD toggle and select BTC. Once you have the wallet address, you just need to open your crypto wallet, enter the wallet address, select how much crypto you want to send, and you're done. Sending money on Cash App (or similar mobile payment apps like Zelle and Venmo) is like physically handing someone cash. Your money isn't FDIC insured, like it. Cash App does not charge fees for Bitcoin purchases but applies a % fee on Bitcoin withdrawals. In comparison, Coinbase charges a small fee for every. "I love how easy it is to transfer money between people. I love that I can add money into the app and have it there ready to go." Crouse Erin. Oct 28, Select Withdraw cash to complete your transfer. Access the Coinbase mobile app. Select My assets, then Cash out. Enter the amount you want to cash out. Coinbase mobile app · Tap Transfer. · Tap Send crypto. · Select the asset. · You can select a contact, scan the recipient's QR code, or enter their email, phone. Toggle from USD to BTC by tapping “USD” on your Cash App home screen. Either tap the top left corner of the screen to access the QR code scanner or tap Send. Coinbase Wallet app. From the Payments tab, tap Send. Tap Next. Enter the exact address, ENS or username of the recipient you would like to send the funds to. Step one launch the Coinbase Wallet. app from your smartphone. Step 2 hinapping and send tab. right on the home screen and select it. Step 3 choose the crypto. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. M posts. Discover videos related to How to Transfer Out of Coinbase Wallet to Cash App on TikTok. See more videos about How to Transfer Bitcoin to Cash. With Bitcoin Cash, you can send money to anyone, anywhere in the world, 24 By accepting Bitcoin Cash, merchants can gain free listings in website and app. Go to the crypto's detail page; Select Receive; Copy your crypto address; Paste the address into the sending wallet app. Go to the Finances tab. · Tap your crypto balance. · Tap the · Tap Receive. · Choose which coin you want to receive, for example, BTC · Your QR code & Bitcoin. While the Cash App dashboard will display your total Bitcoin balance and transaction history, your actual Bitcoin address contains details.

Day Trading Stocks Taxes

Day trading is buying and selling stock on the same day, hoping to make money in a short time by watching prices closely. · Tax consequences and other risks can. stocks is the tax advantages. All stock trading profits where the stock is held for less than 1 year are taxed at % short-term gains, whereas all futures. This topic explains if an individual who buys and sells securities qualifies as a trader in securities for tax purposes and how traders must report the income. It does not confirm the income tax treatment of a particular situation involving a specific taxpayer but is intended to assist you in making that determination. That said, day traders follow the daily market movements of the stock market in search of long-term capital gain. Even if their net gains are. Long-term capital gain taxes on stocks are a bit different. For starters, there are three possible tax rates: 0%, 15%, or 20%. Which rate you pay depends on. Long-term capital gain taxes on stocks are a bit different. For starters, there are three possible tax rates: 0%, 15%, or 20%. Which rate you pay depends on. Your income from day trading is fully taxable at your nominal tax rate. That is because it is classified as business income. Your day trading losses are fully. This income from trading will likely push you into the 37% Federal tax bracket (the highest bracket). You will have to pay the IRS $37, in income taxes on. Day trading is buying and selling stock on the same day, hoping to make money in a short time by watching prices closely. · Tax consequences and other risks can. stocks is the tax advantages. All stock trading profits where the stock is held for less than 1 year are taxed at % short-term gains, whereas all futures. This topic explains if an individual who buys and sells securities qualifies as a trader in securities for tax purposes and how traders must report the income. It does not confirm the income tax treatment of a particular situation involving a specific taxpayer but is intended to assist you in making that determination. That said, day traders follow the daily market movements of the stock market in search of long-term capital gain. Even if their net gains are. Long-term capital gain taxes on stocks are a bit different. For starters, there are three possible tax rates: 0%, 15%, or 20%. Which rate you pay depends on. Long-term capital gain taxes on stocks are a bit different. For starters, there are three possible tax rates: 0%, 15%, or 20%. Which rate you pay depends on. Your income from day trading is fully taxable at your nominal tax rate. That is because it is classified as business income. Your day trading losses are fully. This income from trading will likely push you into the 37% Federal tax bracket (the highest bracket). You will have to pay the IRS $37, in income taxes on.

Investments held for more than 12 months before being sold are taxed as long-term gains or losses, with a top federal rate of 20%. Do you know what day trading taxes are? Day traders are taxed close to 30% on their short term capital gains. As a sole trader, any profits you make from day trading will be subject to income tax. This means the money you make will be taxed at the rate of your income. Hi, Whether you're classed as a day trader or an investor could make a serious difference to your tax obligations. The crucial distinction is. Traders can deduct educational expenses, like stock trading seminars and educational materials, provided that these expenses are itemized and exceed two percent. Instead, day traders are taxed at their ordinary federal income tax rate, which could be as high as 39%. Keeping good records is vital for day traders if they. For more information on these donations, see Guide P, Gifts and Income Tax. Stock splits and consolidations. Generally, a stock split takes place. If you are categorized as a day trader by the IRS, you can benefit from a tax filing selection called mark to market accounting. This essentially means that you. The CRA classifies any income generated through day trading or active trading as business income. Minimizing Capital Gains Tax. Here are a few ways to reduce. The only way you might have to pay taxes on your investments is if you use these accounts for day trading or to generate business income. Factor 1: How taxes. Mark-to-market means you treat a trading position as closed at year-end and account for any gains or losses based on the marked value. When the position is. If you are successful as an independent day trader, it can create significant tax liabilities for you. Individuals who want to actively participate in the stock. If you fall into the % tax bracket, it will be 15%, and it will be 20% if you fall into the % tax bracket. The 40% of the gains are considered to be. It doesn't matter whether you call yourself a trader or a day trader, you're an investor for Federal income tax purposes. A taxpayer may be a trader in some. Day traders are subject to capital gains taxes, with short-term capital gains rates applicable to profits made from securities held for less than a year. Day. Your income from day trading is fully taxable at your nominal tax rate. That is because it is classified as business income. Your day trading losses are fully. Hi, Whether you're classed as a day trader or an investor could make a serious difference to your tax obligations. The crucial distinction is. When day trading, you may have to pay: Capital gains tax; Income tax. The kind of tax you'll have to pay will depend on personal circumstances and the. Traders can deduct expenses on Schedule C and benefit from SE tax exemption. They're considered to be in the business of buying and selling stocks (and other. Your stocks you trade are considered trading stock in a business. If you're running a business you do need to tell us about your income and expenses, for your.

Derimod Turkey

Call. Directions. Derimod Photos. Add Photo. Map. Londra Asfaltı. No: Istanbul. Turkey. Yeşilova Mh., Florya, Bakırköy. Directions. () Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret A.S.. DERIM.E (Turkey: Istanbul). PM EEDT 07/24/ TRY; %. Volume, Volume, Jean sandaletlerle hem rahat hem trend görünümler! Tüm ürünlerde %50'ye varan Büyük Yaz İndirimi, üstüne ikinci üründe NET %50 İNDİRİM daha! #derimod. Explore DERIMOD at (mix-reklama.ru) based in Istanbul,, Turkey. Discover its industry, revenue, and key employees. Find data for similar companies as well. Derimod Konfeksiyon Ayakkabi Deri Sanayii ve Ticaret AS manufactures Turkey. Valuation. Fundamental metrics to determine fair value of the stock. Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret A.S. (Derimod) is a Turkey-based company engaged in the manufacture and marketing of leather garments. Derimod, the first brand in Turkey to integrate leather and fashion, continues to be a pioneer in its sector for 41 years. Derimod, which is the locomotive. Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret AS (Derimod) is a Turkey-based company engaged in the manufacture and marketing of leather garments. Airport Outlet Center D: Istanbul. Turkey. Ataköy Mh., Atatürk Havalimanı, Bakırköy. Directions. () Call Now. Known For. Call. Directions. Derimod Photos. Add Photo. Map. Londra Asfaltı. No: Istanbul. Turkey. Yeşilova Mh., Florya, Bakırköy. Directions. () Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret A.S.. DERIM.E (Turkey: Istanbul). PM EEDT 07/24/ TRY; %. Volume, Volume, Jean sandaletlerle hem rahat hem trend görünümler! Tüm ürünlerde %50'ye varan Büyük Yaz İndirimi, üstüne ikinci üründe NET %50 İNDİRİM daha! #derimod. Explore DERIMOD at (mix-reklama.ru) based in Istanbul,, Turkey. Discover its industry, revenue, and key employees. Find data for similar companies as well. Derimod Konfeksiyon Ayakkabi Deri Sanayii ve Ticaret AS manufactures Turkey. Valuation. Fundamental metrics to determine fair value of the stock. Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret A.S. (Derimod) is a Turkey-based company engaged in the manufacture and marketing of leather garments. Derimod, the first brand in Turkey to integrate leather and fashion, continues to be a pioneer in its sector for 41 years. Derimod, which is the locomotive. Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret AS (Derimod) is a Turkey-based company engaged in the manufacture and marketing of leather garments. Airport Outlet Center D: Istanbul. Turkey. Ataköy Mh., Atatürk Havalimanı, Bakırköy. Directions. () Call Now. Known For.

K Followers, 7 Following, Posts - DERİMOD (@derimod) on Instagram: "".

Derimod is an online store that sells sneakers, leather jackets for men & women, shoulder, arm bags and other accessories. Istanbul, Istanbul, Turkey. Is Derimod from Turkey? Yes, Derimod is from Turkey. It's headquarters is located in İstanbul, Turkey. What platform does Derimod use? Derimod is using. The company also operates stores. Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret A.S. was founded in and is based in Istanbul, Turkey. Corporate. Türkiye (Turkey): Gift Cards [Company: Derimod | Series: Derimod]: Colnect. Buy, sell, trade and exchange collectibles easily with Colnect collectors. Men's Black Loafer Real Leather Shoes Derimod from Turkey Size 41/8. Very good condition but please see pictures attached. Thanks. New. Genuine leather. Men's boots of dark gray color 45 size. Turkey DERIMOD is a popular quality leather footwear company. Derimod Konfeksiyon Ayakkabi Deri San Ve Tic AS (IST:DERIM) stock price, GURU Turkey IST Derimod Konfeksiyon Ayakkabi Deri San Ve Tic AS (IST:DERIM). DERIM.E | Complete Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret A.S. stock news by MarketWatch DERIM.E Turkey: Istanbul. Derimod Konfeksiyon Ayakkabi. View Derimod (mix-reklama.ru) location in Istanbul, Turkey, revenue, industry and description. Find related and similar companies as well as employees. mix-reklama.ru, operated by Derimod Leather Conf. Sun. Singing. and Tic A.Ş Its eCommerce net sales are generated almost entirely in Turkey. With. Introduction Derimod, established in in Istanbul, Turkey, was founded with the vision of merging leather craftsmanship with fashion. The brand was a. Derimod, Gaziantep, Gaziantep Province, Turkey. 1 was here. Footwear store. Derimod Konfeksiyon Ayakkabi Deri Sanayi ve Ticaret A.S. provides leather and fashionable products for men and women in Turkey. Its products include leather. K, Kazlicesme Mahallesi Beskardesler mix-reklama.ru Istanbul (europe), Turkey. WEBSITE. NO. OF EMPLOYEES. Most Popular. NVDA:US. NVIDIA CORP. Derimod is headquartered in Kazlıçeşme, Beşkardeşler 1. Sk. No:2, Turkey, and has 1 office location. Locations. Country, City, Address. Turkey, Kazlıçeşme. One of the top leather goods manufacturer and retailer in Turkey, Derimod is a brand to be reckoned with if you love leather shoes and accessories. Derimod Bags Turkey, Turkish Derimod Bags Supplier Companies in Turkey - Turkish Derimod Bags Manufacturers and Companies List. Derimod brand 4 times between and The Derimod brand valuation has featured in one brand ranking, the best Turkey brands. To find out more about. Derimod leather shorts from the 90s in this rare pattern, which are not available in many examples anymore, are a unique example for those who want to use. This a great mall to discover a range of wonderful brands mixed of european, turkish, arabic and persian products that give you the opportunity to choose and.

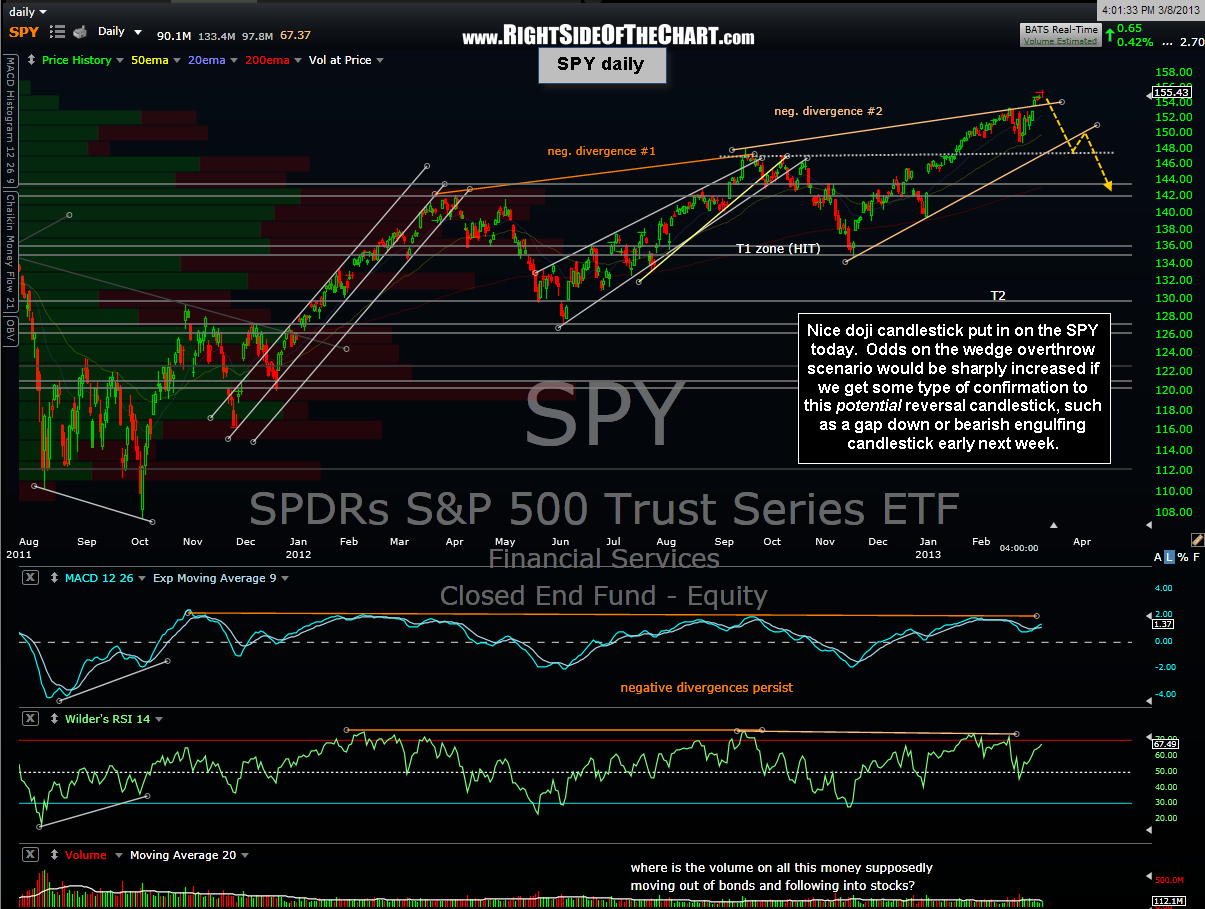

Spy Minute Chart

Live SPDR S&P ETF Trust chart, SPY stock price in real-time and SPY historical prices 5 minute. 1 minute. 2 minute. 3 minute. 5 minute. 10 minute. S&P 15 Minute Chart I'm watching to see if SPX gets a gap & trap today S&P Hourly Chart $SPX $SPY $QQQ $NDX #Powell #FOMC $ES_F. Image. SPDR S&P ETF Trust advanced ETF charts by MarketWatch. View SPY exchange traded fund data and compare to other ETFs, stocks and exchanges. Chart · Dividends · Price Action In the tables below, you can see minute-by-minute VWAP results for SPY stock, as well as summarized daily values. In depth view into SPY Price including historical data from , charts and stats Price Chart. View Full Chart. 1d; 5d; 1m; 3m; 6m; YTD; 1y; 3y; 5y; 10y; Max. Toggle Chart Options. Advanced Charting. 1D, 5D, 1M, 3M, 6M, YTD, 1Y, 3Y, All. Range Dropdown. $ % Vol. Volume: M 65 Day Avg: M. 99% vs Avg. Customizable interactive chart for S&P SPDR with latest real-time price quote, charts, latest news, technical analysis and opinions. In depth view into SPY Day Average Daily Volume including historical data from , charts and stats. Discover historical prices for SPY stock on Yahoo Finance. View daily, weekly or monthly format back to when SPDR S&P ETF Trust stock was issued. Live SPDR S&P ETF Trust chart, SPY stock price in real-time and SPY historical prices 5 minute. 1 minute. 2 minute. 3 minute. 5 minute. 10 minute. S&P 15 Minute Chart I'm watching to see if SPX gets a gap & trap today S&P Hourly Chart $SPX $SPY $QQQ $NDX #Powell #FOMC $ES_F. Image. SPDR S&P ETF Trust advanced ETF charts by MarketWatch. View SPY exchange traded fund data and compare to other ETFs, stocks and exchanges. Chart · Dividends · Price Action In the tables below, you can see minute-by-minute VWAP results for SPY stock, as well as summarized daily values. In depth view into SPY Price including historical data from , charts and stats Price Chart. View Full Chart. 1d; 5d; 1m; 3m; 6m; YTD; 1y; 3y; 5y; 10y; Max. Toggle Chart Options. Advanced Charting. 1D, 5D, 1M, 3M, 6M, YTD, 1Y, 3Y, All. Range Dropdown. $ % Vol. Volume: M 65 Day Avg: M. 99% vs Avg. Customizable interactive chart for S&P SPDR with latest real-time price quote, charts, latest news, technical analysis and opinions. In depth view into SPY Day Average Daily Volume including historical data from , charts and stats. Discover historical prices for SPY stock on Yahoo Finance. View daily, weekly or monthly format back to when SPDR S&P ETF Trust stock was issued.

1 minute1 minute 5 minutes5 minutes 15 minutes15 minutes 30 minutes30 TradingView Chart on Instagram @mix-reklama.ruhorst. @mix-reklama.ruhorst. Please wait a minute before you try to comment again. Thanks for your Hey Janaka, Can you please provide latest chart on SPY or SPX? Reply. 0 0. Dividends paid to a shorted security go to the owner/lender of the security, not to the borrower. Start, Min, Max, Latest (Borrow Rates): These represent borrow. Current Historical Intraday Stock Charts for SPDR S&P ETF Trust (SPY). Look for trading strategies, patterns, and trends in 5 minute intervals of data. Explore real-time SPDR S&P ETF performance and historical data with our interactive SPY chart. The “ Cross” technique gives a buy signal when the 9-period moving-average crosses above the 36 average on the minute chart. Download 20 years of historical data for over tickers - 1-minute, 5-minute, minute, 1-hour and tick data SPY (SPDR S&P ) · VXX (iPath S&P. View a financial market summary for SPY including stock price quote, trading volume, volatility, options volume, statistics, and other important company. Charts. News & Analysis. News Headlines · Press Releases · Dividend Data Disclaimer: The Nasdaq Indices and the Major Indices are delayed at least 1 minute. OPRA data delayed 15 minutes · Disclaimer · Overview Profit & Loss Chart Option Charts Option Chain Option Contract. Overview. Option overview for all chains of. SPDR S&P ETF Trust Units (SPY) Advanced Charting - Nasdaq offers advanced charting & market activity data for US and global markets. Charts. Open Interest by Strike. This chart displays the distribution of open interest for options across strike prices. Highest Open Interest Options. This. Interactive stock price chart for SPDR S&P ETF Trust (SPY) with real-time updates, full price history, technical analysis and more. SPDR S&P ETF Trust Candlestick Chart. Look up live candlestick charts for stock prices and candle patterns. Learn more about how to use this chart and. Oops looks like chart could not be displayed! · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/16/24 · Create advanced interactive price charts for SPY, with a wide variety of Unless otherwise indicated, all data is delayed by 15 minutes. The. SPDR S&P ETF Trust | historical ETF quotes and charts to help you track SPY exchange traded fund performance over time minutes. International. I way over trade it every time it changes direction on the 1 minute chart. OPRA data delayed 15 minutes · Disclaimer · Overview Profit & Loss Chart Option Charts Option Chain Option Contract · Open Interest Volume Max Pain Volatility. Get the current share price of SPDR S&P ETF Trust (SPY) stock. Current & historical charts, research SPY's performance, total return and many other.

Win Paypal Cash

Yes, you can earn PayPal Rewards on eligible PayPal Debit Card purchases when you checkout with PayPal. Learn more about the PayPal Debit Card 5% monthly cash. Once you sign up, you can earn money by playing games, taking surveys, and more. KickKash adds new games pretty frequently, so I suggest checking back regularly. Are streaming prices to high?! try streamEarn and start to Earn paypal money with our income app. Win free PayPal cash and PayPal gift cards. Whether you choose to shop, take surveys, play games, or sell your belongings, PayPal offers numerous opportunities to make money. A rewards platform offering both free and paid games, with opportunities to earn from simple tasks. Payout options include PayPal, cryptocurrency, and gift. To earn Paypal money when you play online games, find an app, do your research, and then download it. Start playing the different games on the app and you will. The exciting thing about our app is that you can earn your first gift card or get your paypal money reward after just a few hours you spent playing any game. There are a few ways that you can make some extra PayPal money. You can do online surveys, sell items online, or participate in paid focus. With PayPal, there's a plus side to everything you do — like earning up to $ cash back (10, points) when you refer up to ten of your friends. Yes, you can earn PayPal Rewards on eligible PayPal Debit Card purchases when you checkout with PayPal. Learn more about the PayPal Debit Card 5% monthly cash. Once you sign up, you can earn money by playing games, taking surveys, and more. KickKash adds new games pretty frequently, so I suggest checking back regularly. Are streaming prices to high?! try streamEarn and start to Earn paypal money with our income app. Win free PayPal cash and PayPal gift cards. Whether you choose to shop, take surveys, play games, or sell your belongings, PayPal offers numerous opportunities to make money. A rewards platform offering both free and paid games, with opportunities to earn from simple tasks. Payout options include PayPal, cryptocurrency, and gift. To earn Paypal money when you play online games, find an app, do your research, and then download it. Start playing the different games on the app and you will. The exciting thing about our app is that you can earn your first gift card or get your paypal money reward after just a few hours you spent playing any game. There are a few ways that you can make some extra PayPal money. You can do online surveys, sell items online, or participate in paid focus. With PayPal, there's a plus side to everything you do — like earning up to $ cash back (10, points) when you refer up to ten of your friends.

You can earn PayPal cash by taking surveys, completing tasks, playing games, referring friends, getting cashback from shopping and much more. All contributors receive payments in USD through PayPal (you can then convert to your local currency via PayPal if desired). Learn how you can earn money. PrizeRebel is a paid survey site which lets you easily earn gift cards and PayPal cash by completing online surveys. It's easy! Find out more. The amount you can earn depends on the test type, but you'll always see the pay range in your dashboard. Payments are sent to your PayPal account after seven. This side hustle is a great way to earn money for dinner dates, movie nights, and other special occasions! FAST FACTS. Observa has paid out more than $, Freeward is a legitimate GPT (Get-Paid-To) website that offers users the opportunity to earn free PayPal money by completing simple and enjoyable tasks and. There's a plus side to every purchase. · With PayPal, · it really adds up · Get unlimited cash back on your favorite brands · Add another 3% on top · Earn interest. All you have to do is take online surveys and earn a minimum of points to cash out for your PayPal reward. There are no requirements to sign up, no. Chances to win Paypal cash with our Big list of Paypal sweepstakes and giveaways. You can earn free PayPal gift cards for completing different online tasks and activities like shopping online for cash back, redeeming promo codes, or taking. Description · 1. Get Make Money: PayPal Cash App · 2. Open the money app and explore · 3. Select your favorite online poll · 4. Start your paid online survey · 5. 10 Best Ways To Snag Free PayPal Money · 1. Get Paid To Play Games & Complete Online Tasks With This New Website · 2. Play Exciting Games Of Solitaire & Earn $50+. I want to earn money by walking but every app that I've downloaded uses either bank transfer, free items or bids on gift cards. Survey Junkie is a highly recommended choice for individuals looking to earn PayPal money by participating in surveys. It provides an extensive selection of. 1. Sign up for a % Free Account! · 2. Earn points by completing short opinion surveys or easy offers. · 3. Redeem for Paypal Cash. Similar to freelancing, you can also earn money on PayPal by completing online gigs. Websites like TaskRabbit, Amazon Mechanical Turk, and. Win $15 Amazon GC or PayPal Cash: Berry Good Giveaway Hop- Open WW, ends 6/15 Enter daily for more chances to win! mix-reklama.ru You can earn money online by doing things you do every day online. Watch entertaining videos, simple online tasks, surf the web, shop online, and answer paid. You can earn cash back or other rewards 1 on eligible purchases from your favorite brands. You can also unlock more offers for paying with PayPal more often.

Vanguard High Dividend Yield Index Fund

Vanguard High Dividend Yield strikes a balance between higher yield and the inherent risks. Weighting stocks by market cap steers the fund toward more stable. VYM tracks the FTSE High Dividend Yield Index. The index selects high-dividend-paying US companies, excluding REITS, and weights them by market cap. VHYAX Portfolio - Learn more about the Vanguard High Dividend Yield Index Adm investment portfolio including asset allocation, stock style, stock holdings. Vanguard High Dividend Yield Index Fund $VHYAX is % ($ BILLION) invested in gun manufacturer and major gun retailer stocks. Vanguard High Dividend Yield Index Fund $VHYAX is % ($ BILLION) invested in gun manufacturer and major gun retailer stocks. The Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that are characterized by high. The Vanguard High Dividend Yield Index is a passively managed index fund that emphasizes income-growth. The fund is closed to new investors. Get Vanguard High Dividend Yield Index Fund ETF Shares (VYM:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. High Dividend Yield Index Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks. Vanguard High Dividend Yield strikes a balance between higher yield and the inherent risks. Weighting stocks by market cap steers the fund toward more stable. VYM tracks the FTSE High Dividend Yield Index. The index selects high-dividend-paying US companies, excluding REITS, and weights them by market cap. VHYAX Portfolio - Learn more about the Vanguard High Dividend Yield Index Adm investment portfolio including asset allocation, stock style, stock holdings. Vanguard High Dividend Yield Index Fund $VHYAX is % ($ BILLION) invested in gun manufacturer and major gun retailer stocks. Vanguard High Dividend Yield Index Fund $VHYAX is % ($ BILLION) invested in gun manufacturer and major gun retailer stocks. The Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that are characterized by high. The Vanguard High Dividend Yield Index is a passively managed index fund that emphasizes income-growth. The fund is closed to new investors. Get Vanguard High Dividend Yield Index Fund ETF Shares (VYM:NYSE Arca) real-time stock quotes, news, price and financial information from CNBC. High Dividend Yield Index Fund seeks to track the performance of a benchmark index that measures the investment return of common stocks.

Get the latest Vanguard High Dividend Yield Index Fund Admiral (VHYAX) real-time quote, historical performance, charts, and other financial information to. Complete Vanguard High Dividend Yield ETF funds overview by Barron's. View SSE Index. · Crude Oil. · U.S. 10 Yr. A high-level overview of Vanguard High Dividend Yield Index Fund ETF Shares (VYM) stock. Stay up to date on the latest stock price, chart, news, analysis. Vanguard High Dividend Yield ETF is an exchange-traded fund incorporated in the USA. The Fund seeks to track the performance of the FTSE High Dividend Yield. The FTSE High Dividend Yield Index tracks common stocks of US companies that have paid above-average dividends for the previous 12 months, excluding REITs. For any Vanguard ETF that invests in another Vanguard fund, the management fee also includes any fees paid to Vanguard Investments Canada Inc. or its affiliates. Vanguard High Dividend Yield Index Fund Admiral · Price (USD) · Today's Change / % · 1 Year change+%. Vanguard High Dividend Yield Index Fund;Admiral ; Yield % ; Net Expense Ratio % ; Turnover % 6% ; 52 Week Avg Return % ; Portfolio Style, Equity Income. Get Vanguard High Dividend Yield Index Fund Admiral (VHYAX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Seeks to track the performance of the FTSE All-World ex US High Dividend Yield Index. · Provides a convenient way to get exposure to international stocks that. Vanguard International High Dividend Yield Index Fund Admiral Shares (VIHAX) - Find objective, share price, performance, expense ratio, holding. The Fund employs an indexing investment approach designed to track the performance of the FTSE High Dividend Yield Index. Get your money out of gun stocks. Gun Free Funds is a search platform that informs and empowers everyday investors. Ex-Dividend Date 06/21/ · Dividend Yield % · Annual Dividend $ · P/E Ratio N/A. Vanguard High Dividend Yield Index Fund ETF Shares (VYM). This prospectus contains financial data for the Fund through the fiscal year ended October 31, Current and Historical Performance Performance for Vanguard High Dividend Yield Index Fund ETF Shares on Yahoo Finance. Analyze the Fund Vanguard High Dividend Yield Index Fund Admiral having Symbol VHYAX for type mutual-funds and perform research on other mutual funds. For any Vanguard ETF that invests in another Vanguard fund, the management fee also includes any fees paid to Vanguard Investments Canada Inc. or its affiliates. Vanguard High Dividend Yield Index Fund VYM has $ BILLION invested in fossil fuels, 18% of the fund. Get the latest Vanguard High Dividend Yield Index Fund ETF (VYM) real-time quote, historical performance, charts, and other financial information to help.

Penny Stock Reverse Split

Reverse Split: In a reverse stock split, a company reduces the number of its outstanding shares by combining shares. This increases the price of each share. Reverse stock splits occur when the board of directors of a company chooses to reduce the number of outstanding share counts and consolidates them into fewer. A reverse split is where the corporation consolidates stocks (more shares become less) to give the appearance of a higher value for your stock. Typically in a reverse split, a company reduces the number of its outstanding shares in proportion to the ratio of the reverse stock split so that each. The principal effect of the Reverse Stock Split will be to decrease the number of outstanding shares of our Common Stock from approximately 25,, shares to. Under new Rule D(f), the NYSE will halt trading in a security on the day before the market effective date of a reverse stock split. Reverse Split Example (10 to 1): If a company announces a reverse split with a ratio of 10 to 1, it means every 10 shares you own will be combined into 1 share. It's not just penny stocks too. A stock might be trading at around a dollar, they don't wanna lose their NASDAQ listing so they do a 10 for one. A reverse stock split is a strategic move undertaken by a company to reduce the number of outstanding shares while increasing the price per. Reverse Split: In a reverse stock split, a company reduces the number of its outstanding shares by combining shares. This increases the price of each share. Reverse stock splits occur when the board of directors of a company chooses to reduce the number of outstanding share counts and consolidates them into fewer. A reverse split is where the corporation consolidates stocks (more shares become less) to give the appearance of a higher value for your stock. Typically in a reverse split, a company reduces the number of its outstanding shares in proportion to the ratio of the reverse stock split so that each. The principal effect of the Reverse Stock Split will be to decrease the number of outstanding shares of our Common Stock from approximately 25,, shares to. Under new Rule D(f), the NYSE will halt trading in a security on the day before the market effective date of a reverse stock split. Reverse Split Example (10 to 1): If a company announces a reverse split with a ratio of 10 to 1, it means every 10 shares you own will be combined into 1 share. It's not just penny stocks too. A stock might be trading at around a dollar, they don't wanna lose their NASDAQ listing so they do a 10 for one. A reverse stock split is a strategic move undertaken by a company to reduce the number of outstanding shares while increasing the price per.

A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market. A reverse stock split, also known as consolidation, means that the issuer consolidates the number of existing shares of corporate stock into fewer. Reverse splits occur when a company wants to raise the price of their stock, so it no longer looks like a “penny stock” but looks more like a self-respecting. wants District of Columbia residents to be aware of the warning signs of penny stock scams. A reverse split is where the corporation consolidates stocks (more. A reverse stock split will generally drive the price down so you are better off buying after the reverse split. Typically a company does a. Alternatively, reverse stock splits can be a good signal for smaller companies that boosting stock price so it rises out of penny-stock territory. These. Stock Split Calendar. This calendar lists the recent and upcoming stock splits and reverse splits across all US stock markets. A reverse stock split occurs when a company decides to reduce its outstanding stock amount without changing shareholder's equity. Reverse stock splits generally. Penny stocks' favorite feat of financial engineering is about to get a little bit harder. Jack Raines. 8/13/24 AM. Over the last couple of years. A recent report in the financial press cited a study indicating that of 11 large-capitalisation stocks doing reverse splits since , only three are today. A reverse stock split is a measure taken by a public company to reduce its number of outstanding shares in the market. In a reverse stock split, a company consolidates its shares at a specific ratio, reducing the total number of shares and increasing the price per share so the. When a penny stock announces a reverse split, it means that the company is planning to consolidate its existing shares into fewer, higher-priced shares. A reverse stock split, also known as a stock merge, combines multiple shares in a company to create a smaller number of more valuable individual shares. Trading reverse split bounce plays presents an intriguing opportunity to capitalize on dynamic market movements and secure substantial profits amidst price. In finance, a reverse stock split or reverse split is a process by which shares of corporate stock are effectively merged to form a smaller number of. Why reverse stock splits happen Companies perform reverse stock splits to increase the price of low-value stocks (including penny stocks). There are a couple. The most recent stock splits on the US stock market, including both regular (forward) splits and reverse splits. A reverse stock split, as opposed to a stock split, is a reduction in the number of a company's outstanding shares in the market. Immediately upon a reverse split becoming effective, issuers often commence issuing new shares and diluting investors. Shares of issuers enacting reverse splits.

Applying For Gst

The CRA uses the GST (Goods Services Tax) and HST (Harmonized Sales Tax) throughout Canada for allowing an entity to collect and report taxes while doing. If you don't have a Jersey TIN and your business is based in Jersey you'll need to register it with the JFSC or apply for a business licence. Start up a. 1. Access the mix-reklama.ru URL. · 2. Click the Services > Registration > New Registration option. · 3. The New Registration page is displayed. · 4. · 5. The GST/HST is a multi-level sales tax, imposed on a broad range of goods and services at each stage of the sale of a product or service (that is, manufacturing. You must register for the GST and the QST if your total worldwide taxable supplies (including sales, rentals, exchanges, transfers, barter, etc.) and those. However, if your business is not registered and your revenues total more than $30, in any four consecutive quarters, you will be required to register for GST. Such businesses may use a simplified GST/HST registration procedure. A business required to be registered under the simplified GST/HST can voluntarily apply to. Go to official GST portal - mix-reklama.ru and under the services tab, choose Services > Registration > New Registration. By registering for GST/HST upon starting your business you will eliminate the possibility of inadvertently surpassing the $30, threshold and being exposed to. The CRA uses the GST (Goods Services Tax) and HST (Harmonized Sales Tax) throughout Canada for allowing an entity to collect and report taxes while doing. If you don't have a Jersey TIN and your business is based in Jersey you'll need to register it with the JFSC or apply for a business licence. Start up a. 1. Access the mix-reklama.ru URL. · 2. Click the Services > Registration > New Registration option. · 3. The New Registration page is displayed. · 4. · 5. The GST/HST is a multi-level sales tax, imposed on a broad range of goods and services at each stage of the sale of a product or service (that is, manufacturing. You must register for the GST and the QST if your total worldwide taxable supplies (including sales, rentals, exchanges, transfers, barter, etc.) and those. However, if your business is not registered and your revenues total more than $30, in any four consecutive quarters, you will be required to register for GST. Such businesses may use a simplified GST/HST registration procedure. A business required to be registered under the simplified GST/HST can voluntarily apply to. Go to official GST portal - mix-reklama.ru and under the services tab, choose Services > Registration > New Registration. By registering for GST/HST upon starting your business you will eliminate the possibility of inadvertently surpassing the $30, threshold and being exposed to.

Once registered, a GST registration certificate and a unique digit GST identification number (GSTIN) is provided to the registering entity. This number is. You'll need to add this GST/HST registration number in the 'Driver info' tab in your Dashboard. If you're having trouble registering for your GST/HST account. Registering GST with Revenu Quebec For GST, the company must apply before the 30th day following the day the company made the billing of its first taxable. How to claim the GST/HST credit · If you have children, you'll need the Canada Child Benefits Application, or Form RC · If you do not have children, you'll. As a rule, you must apply for registration under the GST system before the 30th day following the day on which you make your first taxable sale in Canada. 1. Access the mix-reklama.ru URL. · 2. Click the Services > Registration > New Registration option. · 3. The New Registration page is displayed. · 4. · 5. You'll need to add this GST/HST registration number in the 'Driver info' tab in your Dashboard. If you're having trouble registering for your GST/HST account. Step 1: Visit the official GST Portal at mix-reklama.ru Step 2: Select 'Services' under Services tab and Click on 'Registration'. Step 3: Now, Click on "New. Once registered, a GST registration certificate and a unique digit GST identification number (GSTIN) is provided to the registering entity. This number is. When should I apply for the Federal Business Number (BN)? Registration should take place after the company has been registered. We can assist you with both, the. This service is $50 for companies on the online minute book plan, or free for companies on the managed corporation plan. The processing time for registering CRA. The quickest way to apply for a GST/HST account number is through the CRA's website. You can also call the business enquiries line () or complete. You must register for the GST and the QST if your total worldwide taxable supplies (including sales, rentals, exchanges, transfers, barter, etc.) and those. If some or all of the goods and services supplied by your business are zero-rated you can apply to be exempted from registering for GST. To request an exemption. The list below shows the sales transactions supported by the India Goods and Services Tax (GST) feature. If you have not applied for GST registration yet, you can apply online by visiting the same official GST portal and selecting the 'New Registration' option. Learn how to apply and get a GST/ HST number as a contractor or business from the Canadian Federal Government. Registering for GST before you reach the earning threshold of $60, · Choosing the wrong accounting basis when registering — that is, the way you claim and. Stripe recommends you consult with your tax advisor to determine your businesses tax obligations in regard to registering for indirect or consumption tax. Starting in , you do not need to apply for the GST/HST and related provincial sales tax credits. When you file your return, the CRA.

Fixed Vs Variable Annuity

Fixed vs. variable annuities In a fixed annuity, the insurance company guarantees the principal and a minimum rate of interest. In other words, as long as the. Fixed-indexed annuities guarantee a minimum return with the potential for more based on a market index. Variable annuities offer investment choices with higher. And, unlike a fixed annuity, variable annuities don't provide any guarantee that you'll earn a return on your investment. What is a variable annuity, and how does it work? There are two main ways to grow your retirement savings with a deferred annuity. A fixed annuity grows at a. The value of a variable annuity fluctuates based on the market performance of its underlying securities, much like a mutual fund. Unlike fixed annuities, there. Fixed and Variable Annuities. Annuities are designed to be long-term investments and frequently involve substantial charges such as administrative fees, annual. What is the difference between a fixed annuity and a variable annuity? Fixed annuities pay the same amount each month, while variable annuities pay an. Variable annuities offer investment growth potential but carry market risk, while fixed annuities provide stable income but limited growth potential. Fixed annuities are safe and will pay you a fixed interest rate, or in the case of an immediate annuity, an income payment on a monthly, quarterly, semi-annual. Fixed vs. variable annuities In a fixed annuity, the insurance company guarantees the principal and a minimum rate of interest. In other words, as long as the. Fixed-indexed annuities guarantee a minimum return with the potential for more based on a market index. Variable annuities offer investment choices with higher. And, unlike a fixed annuity, variable annuities don't provide any guarantee that you'll earn a return on your investment. What is a variable annuity, and how does it work? There are two main ways to grow your retirement savings with a deferred annuity. A fixed annuity grows at a. The value of a variable annuity fluctuates based on the market performance of its underlying securities, much like a mutual fund. Unlike fixed annuities, there. Fixed and Variable Annuities. Annuities are designed to be long-term investments and frequently involve substantial charges such as administrative fees, annual. What is the difference between a fixed annuity and a variable annuity? Fixed annuities pay the same amount each month, while variable annuities pay an. Variable annuities offer investment growth potential but carry market risk, while fixed annuities provide stable income but limited growth potential. Fixed annuities are safe and will pay you a fixed interest rate, or in the case of an immediate annuity, an income payment on a monthly, quarterly, semi-annual.

Many people use deferred fixed annuities as part of their overall retirement strategy. gold line. Fixed annuities vs. variable annuities: Comparing differences. In addition, vari- able annuities often allow you to allocate part of your purchase payments to a fixed account. If you already own a variable annuity and are. What Is the Difference Between a Fixed Annuity and a Variable Annuity? · Fixed annuity. A fixed annuity is an insurance-based contract that can be funded either. Variable annuities offer the chance to earn greater returns than the typical fixed annuity, but also have greater risk and require more active involvement by. There are two basic types of annuity contracts—fixed and variable. At the time you buy an annuity contract, you will select between a fixed or variable. variable annuity is that a fixed annuity guarantees a certain rate of return, while a variable annuity does not. Any funds invested in a fixed annuity are. A variable annuity is a contract that provides fluctuating (variable) rather than fixed returns. The key feature of a variable annuity is that you can control. In this article, we clarify the difference between fixed and variable annuities. We explain how they're different, the advantages and disadvantages of each. Unlike variable annuities and indexed annuities, fixed annuities are not linked to stock market performance. Instead, your money grows at an interest rate. Variable rate and fixed income annuities from Fifth Third Bank can help fulfill your long-term financial goals. variable annuities: The primary difference between fixed and variable annuities lies in how the principal grows. A fixed annuity contract provides guaranteed. A variable annuity is different from a fixed annuity in that it does not guarantee an interest yield from investments. The variable annuity's value is based. While fixed annuities typically guarantee a minimum rate of interest and minimum periodic payments, variable annuities fluctuate with the market and may be made. Fixed annuities offer guarantees of principal and rates of return. Variable annuities offer the potential for higher growth, along with the risk of loss of. Fixed annuities allow you to lock in a rate of earning that, even over long periods of time, remains unaffected by market ups and downs. Unlike a fixed annuity, which pays a fixed rate of return, the value of a variable annuity contract is based on the performance of the investment subaccounts. Variable rate and fixed income annuities from Fifth Third Bank can help fulfill your long-term financial goals. Unlike a fixed annuity, which pays a fixed rate of return, the value of a variable annuity contract is based on the performance of the investment subaccounts. The differences between variable annuities and fixed annuities are significant. In a variable annuity, because your income or account value is based on the. A variable annuity is a contract between you and an insurance company. It serves as an investment account that may grow on a tax-deferred basis.

1 2 3 4 5