mix-reklama.ru

Overview

Best Banks For Private Student Loans

Best private student loans · Best for flexible repayment terms: College Ave · Best for low rates: Sallie Mae · Best for applying without a co-signer: Ascent · Best. See current private student loan rates and explore Bankrate's expert picks for the best private student loans to help pay for college. lender as one of the best private student loans. Best overall: College Ave; Best for cosigners: Sallie Mae; Best for large loans: Earnest; Best for member. View our top-rated private student loans available in the market. A comparison of interest rates and provide a wealth of information for each lender. Best for flexible repayment terms: College Ave · Best for low rates: Sallie Mae · Best for applying without a co-signer: Ascent · Best for fair credit: Earnest. Fund your education with flexible private loans from Earnest. Get the guidance you need with expert in-house support. No fees, ever. PNC Bank can help finance your education with a private student loan. Find the right student loan solution for your future. Find and compare the top private student loan lenders. borrowers can use private student loans to help pay for things like tuition, room and board, books. Sallie Mae® – Graduate Student Loans. Get the money you need to pay for your graduate degree or post-graduate studies. Apply once to get money for the whole. Best private student loans · Best for flexible repayment terms: College Ave · Best for low rates: Sallie Mae · Best for applying without a co-signer: Ascent · Best. See current private student loan rates and explore Bankrate's expert picks for the best private student loans to help pay for college. lender as one of the best private student loans. Best overall: College Ave; Best for cosigners: Sallie Mae; Best for large loans: Earnest; Best for member. View our top-rated private student loans available in the market. A comparison of interest rates and provide a wealth of information for each lender. Best for flexible repayment terms: College Ave · Best for low rates: Sallie Mae · Best for applying without a co-signer: Ascent · Best for fair credit: Earnest. Fund your education with flexible private loans from Earnest. Get the guidance you need with expert in-house support. No fees, ever. PNC Bank can help finance your education with a private student loan. Find the right student loan solution for your future. Find and compare the top private student loan lenders. borrowers can use private student loans to help pay for things like tuition, room and board, books. Sallie Mae® – Graduate Student Loans. Get the money you need to pay for your graduate degree or post-graduate studies. Apply once to get money for the whole.

Earnest offers a wide variety of student loans, including some specialized graduate loans and refinance loans. International students can apply without a. Its lending process is completely online. Like many private student loan lenders, it offers a % autopay discount, and borrowers may qualify for a %. Compare the best private student loans for college. Choose the lender with the best interest rate and repayment options. lender as one of the best private student loans. Best overall: College Ave; Best for cosigners: Sallie Mae; Best for large loans: Earnest; Best for member. Best for flexible repayment terms: College Ave · Best for low rates: Sallie Mae · Best for applying without a co-signer: Ascent · Best for fair credit: Earnest. I'd go with College Ave or Sallie Mae for private loans since they often allow deferring payments until after graduation. Upvote. best pricing and terms. What are Private Student Loans? Private student loans are credit-based loans applied for through individual banks that help students. They almost always cost less and are easier to repay. (This may not be the case if you are a parent or graduate student considering federal PLUS loans, though.). Eligibility requirements vary and most private lenders offer a variety of options when it comes to private student loans. loan is best for you and your. Best Private Student Loans · Best Student Loan Refinance Companies · Student Best Lenders for Refinancing Student Loans for Borrowers With No Degree. I used Sallie Mae when my son reached his maximum loan amount from Federal Student loans. It's a great alternative for students and parents when other. Private Loans. Private student loans provided by banks, credit unions, and other lenders can help bridge the gap between the financial aid you have already. Get a rate quote in about 2 minutes with no credit hit, and choose the rate type that works best for you. Keep in mind, our lowest rates include a combined. Private loans are offered by private lenders and there are no federal forms to complete. Best Graduate Student Loans · Educators and Financial Aid. Top 10 Private Student Loans of · College Ave · Discover · Earnest · Education Loan Finance (ELFI) · Laurel Road · LendKey · Sallie Mae · SoFi. Many lenders offer private loans for students who need additional aid to attend college lenders to obtain the loan that best fits your needs. You may. Lenders that may offer international student private loans without a U.S. co-signer include MPower Financing, Ascent (specifically for DACA students), Prodigy. Best Lenders for Private Student Loans · Sallie Mae · College Ave · Credible · SoFi · Ascent Funding · Earnest · Citizens. Private student loans can help pay for your education, but be sure to shop around for the best deal. See rates from LendingTree's top student loan lenders. Private loans are available from lenders such as banks or credit unions. More about private student loans: Private student loans are best used to fill a payment.

What Does A Cashiers Check Look Like

These are fake cashiers checks. They are very easy to spot. If you read the computer generated letter you can tell right away it's a scam. How Do Cashier's Checks Work? The way that a cashier's check works is that the payer requests a cashier's check at the financial institution where they have. A cashier's check is a check written by a financial institution on its own funds, signed by a representative, and made payable to a third party. To counter this, banks offer cashier's checks. A cashier's check is a check written by the bank, rather than the customer, and comes from a bank-controlled. A cashier's check is a check guaranteed by a bank, drawn on the bank's funds and signed by a bank employee. Cashier Check, Cashiers Check How Does It Work, What Does The Cashier Look Like, Cashier Checks As Cash, What Does Bank of America Check Look Like, Whats A. How Much Do Cashier's Checks Cost? Expect to pay a fee of about $8 to $15 to get a cashier's check from your bank or credit union. These are the. Cashier's checks are checks that banks issue and guarantee, and they are often needed for large purchases, like a car, or the down payment on a house. These. (Bouncing a check could lead to overdraft or returned check like a real estate transaction, because cashier's checks clear quicker than traditional checks. These are fake cashiers checks. They are very easy to spot. If you read the computer generated letter you can tell right away it's a scam. How Do Cashier's Checks Work? The way that a cashier's check works is that the payer requests a cashier's check at the financial institution where they have. A cashier's check is a check written by a financial institution on its own funds, signed by a representative, and made payable to a third party. To counter this, banks offer cashier's checks. A cashier's check is a check written by the bank, rather than the customer, and comes from a bank-controlled. A cashier's check is a check guaranteed by a bank, drawn on the bank's funds and signed by a bank employee. Cashier Check, Cashiers Check How Does It Work, What Does The Cashier Look Like, Cashier Checks As Cash, What Does Bank of America Check Look Like, Whats A. How Much Do Cashier's Checks Cost? Expect to pay a fee of about $8 to $15 to get a cashier's check from your bank or credit union. These are the. Cashier's checks are checks that banks issue and guarantee, and they are often needed for large purchases, like a car, or the down payment on a house. These. (Bouncing a check could lead to overdraft or returned check like a real estate transaction, because cashier's checks clear quicker than traditional checks.

A legitimate cashier's check has a microprint border around its four edges. It also has a watermark printed on the back. But, a scammer can easily print that on. A cashier's check will be signed by a bank cashier – or sometimes two – and will also feature the bank's watermark to ensure its authenticity. They're purchased. One such method is the cashier's check, which is a type of check that is issued by a bank and guaranteed to be paid by the bank. While cashier's checks can be a. If you have a Navy Federal checking or savings account, you can request a cashier's check. Each cashier's check is signed by one or more official bank employees and may include extra security features like additional watermarking. Plus, it has the. mix-reklama.ru at the edges. Most checks that were written by a legitimate business have one edge that is rough or perforated. · mix-reklama.ru the bank logo. A cashier's check is a check that offers significantly more security to the payee because it's drawn against the bank's funds and not against an individual. Fake checks might look like business or personal checks, cashier's checks, money orders, or a check delivered electronically. How long does it take for a cashier's check to clear? Ans. The time it takes for a cashier's check to clear depends on the financial institution. Generally, the. Cashier's checks are checks guaranteed by a financial institution, drawn from its own funds and signed by a cashier or teller. Cashier's checks are typically. Also called a cashier check or bank draft, a cashier's check is a check that is issued and guaranteed by a bank. Here's a look at why you might want to use a. Cashier's checks “checks issued by a bank” are considered by many to be risk-free. The funds are paid out by the bank, not the buyer. You should be aware of a type of scam involving fraudulent cashier's checks, money orders and other official-looking bank checks. Unlike personal checks, which can bounce if there aren't enough funds in the account to cover it, cashier's checks are only issued if there's cash in your. Cashier's checks are issued by a bank, are available in higher dollar amounts, are considered more secure than money orders, and have higher fees than money. Because a cashier's check is issued by a bank, itself, the cashier's check is paid by funds of the bank and not the depositor. Therefore, if an item is genuine. Fake checks come in many forms. They might look like business or personal checks, cashier's checks, money orders. If you have a Navy Federal checking or savings account, you can request a cashier's check. You should be aware of a type of scam involving fraudulent cashier's checks, money orders and other official-looking bank checks.

Aws Cloud Certification Training

TRAINING AND CERTIFICATION. From a non-IT background, switching to a cloud career? Start with: AWS Certified. Cloud Practitioner to validate foundational AWS. In this course, you'll learn how to pass the AWS Certified Solutions Architect – Associate Exam, Design Highly Resilient and Scalable Websites. Take an AWS course taught by real world experts. With Udemy, you can get the help you need to prepare for your AWS Certification exam with lecture videos. Best-in-class video course with 9+ hrs videos and 4 full-length practice exams which include + aws cloud practitioner practice exam questions & 50+ AWS. AWS Training and Certification · Explore what's new · Develop your generative AI career with training content built by AWS experts · Grow your cloud career with. The AWS Certified Cloud Practitioner Exam is specially made for those with a basic understanding of the AWS platform. It is recommended that you have at least. In summary, here are 10 of our most popular aws courses · AWS Fundamentals · AWS Cloud Solutions Architect · mix-reklama.ru Data Engineering · AWS Cloud Support. Thus, AWS Certifications are perfect for those looking to advance their cloud computing, DevOps, and software development careers. This 1-day training course is. Use our digital badges to showcase your achievements, including AWS Certifications, which validate your cloud skills with an industry-recognized credential. TRAINING AND CERTIFICATION. From a non-IT background, switching to a cloud career? Start with: AWS Certified. Cloud Practitioner to validate foundational AWS. In this course, you'll learn how to pass the AWS Certified Solutions Architect – Associate Exam, Design Highly Resilient and Scalable Websites. Take an AWS course taught by real world experts. With Udemy, you can get the help you need to prepare for your AWS Certification exam with lecture videos. Best-in-class video course with 9+ hrs videos and 4 full-length practice exams which include + aws cloud practitioner practice exam questions & 50+ AWS. AWS Training and Certification · Explore what's new · Develop your generative AI career with training content built by AWS experts · Grow your cloud career with. The AWS Certified Cloud Practitioner Exam is specially made for those with a basic understanding of the AWS platform. It is recommended that you have at least. In summary, here are 10 of our most popular aws courses · AWS Fundamentals · AWS Cloud Solutions Architect · mix-reklama.ru Data Engineering · AWS Cloud Support. Thus, AWS Certifications are perfect for those looking to advance their cloud computing, DevOps, and software development careers. This 1-day training course is. Use our digital badges to showcase your achievements, including AWS Certifications, which validate your cloud skills with an industry-recognized credential.

AWS Professional requirement by AWS: 2 years of comprehensive experience designing, operating, and troubleshooting solutions using the AWS Cloud. This. The various certifications in the AWS category are: AWS DevOps Engineer Professional Certification · AWS Cloud Migration Certification · AWS Developer Associate. All Courseware & eLearning. Instructor-led training. Self-paced training. Books ; AWS Cloud Practitioner. AWS Developer - Associate. AWS DevOps Engineer -. This course is the first step in training for the industry-leading Amazon AWS product. It serves as a thorough introduction to the services and solutions. Choose from role-based and specialty certifications and validate your cloud expertise with an industry-recognized credential. Explore AWS Certifications! Choose from role-based and specialty certifications and validate your cloud expertise with an industry-recognized credential. Explore AWS Certifications! This AWS certification training will enable you to master the core skills required for designing and deploying dynamically scalable, highly available, fault-. AWS Cloud Institute is designed to take you from a non-tech role to a role where you're developing in the AWS Cloud in as little as one year. If you're. AWS Certification training offered by the University of Houston, you will build unmatched technical expertise and advanced skills that improve your knowledge. AWS Courses · AWS Advanced Architecting on AWS Boot Camp · AWS Architecting on AWS Boot Camp · AWS Certified Developer Associate Boot Camp · AWS Certified Solutions. Digital Cloud Training offers the best AWS certification training courses that will get you AWS certified and master Amazon Web Services. AWS Academy provides higher education institutions with a free, ready-to-teach cloud computing curriculum that prepares students to pursue industry-recognized. The AWS Cloud Practitioner certification serves as an excellent starting point for IT professionals looking to advance their careers in the cloud computing. Enroll in digital courses where you need to fill gaps in knowledge and skills, practice with AWS Builder Labs, AWS Cloud Quest, and AWS Jam. 3. Review and. Where do I register for an AWS Certification exam or access my AWS Certification Account? AWS Classroom Training offers live classes with instructors who teach you in-demand cloud skills and best practices using a mix of presentations, discussion. AWS experts and build cloud skills online. With access to + free courses, certification exam prep, and training that allows you to build practical skills. This four-week course prepares sales, support, legal, finance, marketing and managerial personnel for the AWS Cloud Practitioner certification exam. Class meets. Where do I register for an AWS Certification exam or access my AWS Certification Account? The AWS Certification Paths · AWS Certified: Solutions Architect Professional · AWS Certified: Solutions Architect Associate · AWS Certified: DevOps Engineer.

Denied Auto Loan Now What

Options · What Not to Do What you should not do is nothing. Ignoring the problem will likely result in the vehicle being repossessed and the cost of the towing. If your loan application is denied because of information on your credit report, you have 60 days to request a free copy of the credit report used in the. The good news is that car loan denials after approval are indeed very rare, and the reason they happen at all is tied to the fine print of a contract. Your best. Rate shopping should not impact your credit score negatively. Do not sign an authorization that allows a prospective lender, like a car dealer, to pull your. What kind of credit score do I need to get a car loan? We don't require a set credit score to qualify for an auto loan with us. We take many factors into. They will if you want to finance through them. Use the already approved loan if you do not want them to pull your credit. And sometimes they. Can a car loan be denied after approval? Yes, in some very rare cases, car loans can be denied by the bank/lender even after the final approval and signing of. Get the answers you need to common questions about new, used and refinance auto loans What types of car loans do you offer? Bank of America offers a variety. About a third of Americans (%) think they'd be rejected for a car loan, according to a February survey from the New York Fed's Center for. Options · What Not to Do What you should not do is nothing. Ignoring the problem will likely result in the vehicle being repossessed and the cost of the towing. If your loan application is denied because of information on your credit report, you have 60 days to request a free copy of the credit report used in the. The good news is that car loan denials after approval are indeed very rare, and the reason they happen at all is tied to the fine print of a contract. Your best. Rate shopping should not impact your credit score negatively. Do not sign an authorization that allows a prospective lender, like a car dealer, to pull your. What kind of credit score do I need to get a car loan? We don't require a set credit score to qualify for an auto loan with us. We take many factors into. They will if you want to finance through them. Use the already approved loan if you do not want them to pull your credit. And sometimes they. Can a car loan be denied after approval? Yes, in some very rare cases, car loans can be denied by the bank/lender even after the final approval and signing of. Get the answers you need to common questions about new, used and refinance auto loans What types of car loans do you offer? Bank of America offers a variety. About a third of Americans (%) think they'd be rejected for a car loan, according to a February survey from the New York Fed's Center for.

What To Do if a Car Loan is Denied When you're denied an auto loan due to either income or credit restrictions, your solution changes depending on the issue. Can You Be Denied a Car Loan after Pre-Approval? It's rare, but it happens. It could be that a preliminary look at your finances painted one picture, but on. What credit score do you need to lease a car?» Will I get denied a car loan with bad credit? May 12, At Toyota Direct, we understand that finding the. It is rare that you would get denied a car loan after getting pre-approved. Most financial warning signs, like a low credit score, high debt income ratio, and. Can You Be Denied a Car Loan After Pre-Approval? Unfortunately, incidents have occurred in which a bank denied a loan after the purchase of the car. This may. What do you do when the dealer tells you your loan was approved, but later calls to say the loan was denied and demands the car back unless you pay more. An absence of credit is yet another reason why applications might be denied, and you might need a cosigner with a solid credit score for your loan. However. Now, if you refused, they could take legal action and tow it or sue to get it back but if it has been recovered and returned, that should end the dispute. If you get denied twice, by an auto loan company and a company that specializes in bad credit loans, you need to stop applying for loans and find other ways to. A third reason why lenders may deny an application is due to the absence of credit. If you want to secure a car loan but have no credit, the loan lender has. What to do if your car loan was denied · Contact your lender · Improve credit score · Minimize your debt · Look for poor credit lenders. The reasons for car loan denial are often right under a person's nose. When If those details still linger on your report, the lenders, who have now. If you've been denied for a loan, request copies of your credit report from the major credit bureaus and look closely for any inaccurate information. When someone applies for a car loan, there are two choices for an auto lender. Approve or decline. That is it. Now the question is why? Why do auto dealers. Besides having a low credit score, other reasons for being declined for a personal loan include having a high debt-to-income (DTI) ratio and. denied an auto loan after driving the car off the lot? Received a letter in the mail denying an auto loan but I have already had the car home. We suggest lifting all credit freezes for at least seven days. However, if a credit approval expires prior to the vehicle delivery date, credit freezes may need. hubby & I got denied from our credit union (psecu) for an auto loan, and we are now paying some things off our credit now, and credit report. You may even be denied for a loan, depending on how bad it is. And your interest rate will significantly impact your monthly payment. It's best, if you have the.

Understanding Bank Interest Rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). Conversely, when inflation is high, interest rates are usually higher. Part of this has to do with the federal funds rate — the interest rate at which banks. Interest is the price you pay to borrow money. When a lender provides a loan, they make a profit off of the interest paid on top of the original loan amount. A “nominal interest rate” is the rate that banks and financial institutions quote or state. It does not consider inflation. It is the actual rate paid. For. You are borrowing money and paying interest for a shorter amount of time; The interest rate is usually lower—by as much as a full percentage point. However, a. Interest is calculated based on the amount of funds in the account. The greater the sum of the funds in the account, the more interest you gain. Discover our. The Bank Rate sets the amount of interest paid to commercial banks, which in turn influences the rates they charge customers to borrow, or pay to them for. The rate of interest is the cost of using someone else's money. Posted on: March 31, bank accounts · banking · borrowing · credit · economy. Have you ever wondered what an interest rate hike or cut means for your personal finances? When the Federal Reserve changes rates, it can influence how much. An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). Conversely, when inflation is high, interest rates are usually higher. Part of this has to do with the federal funds rate — the interest rate at which banks. Interest is the price you pay to borrow money. When a lender provides a loan, they make a profit off of the interest paid on top of the original loan amount. A “nominal interest rate” is the rate that banks and financial institutions quote or state. It does not consider inflation. It is the actual rate paid. For. You are borrowing money and paying interest for a shorter amount of time; The interest rate is usually lower—by as much as a full percentage point. However, a. Interest is calculated based on the amount of funds in the account. The greater the sum of the funds in the account, the more interest you gain. Discover our. The Bank Rate sets the amount of interest paid to commercial banks, which in turn influences the rates they charge customers to borrow, or pay to them for. The rate of interest is the cost of using someone else's money. Posted on: March 31, bank accounts · banking · borrowing · credit · economy. Have you ever wondered what an interest rate hike or cut means for your personal finances? When the Federal Reserve changes rates, it can influence how much.

Interest rate refers to the amount charged by a lender. When you borrow money from a bank or other lender, interest is the primary method by which the lender. An interest rate refers to the amount charged by a lender to a borrower for any form of debt given, generally expressed as a percentage of the principal. The rate on the deposit facility, which banks can use to make overnight deposits with the Eurosystem. · The interest rate on the main refinancing operations. ARM interest rates and payments are subject to increase after the initial fixed-rate How Much Should You Put Down? Understanding Your Mortgage Options · APR. When you borrow money, interest is the fee you pay for using it, usually shown as an annual percentage of the loan or credit card amount. When the Fed cuts interest rates they are lowering the fed funds target rate. This is the rate banks charge each other when lending money overnight. 2. Interest rates on different consumer products may fluctuate. When rates increase, banks and credit unions raise annual percentage yields (APYs) on deposit. Interest earned is like bonus money the bank pays you just for keeping money in an account, such as savings. Interest owed is the fee you pay when you borrow. Learning about personal finance and reading retirement and investment advice is often times too complex to really understand what needs to be done. The interest rate restrictions generally limit a less than well capitalized institution from soliciting deposits by offering rates that significantly exceed. The difference between the face value and the discounted price you pay is "interest." To see what the purchase price will be for a particular discount rate, use. Borrowing Costs: When interest rates are high, the cost of borrowing money through loans, credit cards, or mortgages increases. · Earnings on Savings. The interest paid on high-interest savings accounts is usually set to a variable rate — so when interest rates rise, account holders earn a higher return. Keep. Financial institutions tend to advertise APY over interest rates with savings accounts to help you understand how much money you'd earn over time. The. When a bank or lender extends a line of credit to a borrower, they are taking a risk and interest can be thought of as a service fee for this risk. Interest. In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate that's typically. It specifies what savers receive on their savings / what borrowers have to pay for a loan for a given period (usually one year). The interest rate may be either. What is a Bank? · They make money from what they call the spread, or the difference between the interest rate they pay for deposits and the interest rate they. The rate of interest measures the percentage reward a lender receives for deferring the consumption of resources until a future date. The interest rate you earn works exactly the same way as if you borrow. The reason is simple - if you loan money to a bank or keep it in your account, it will.

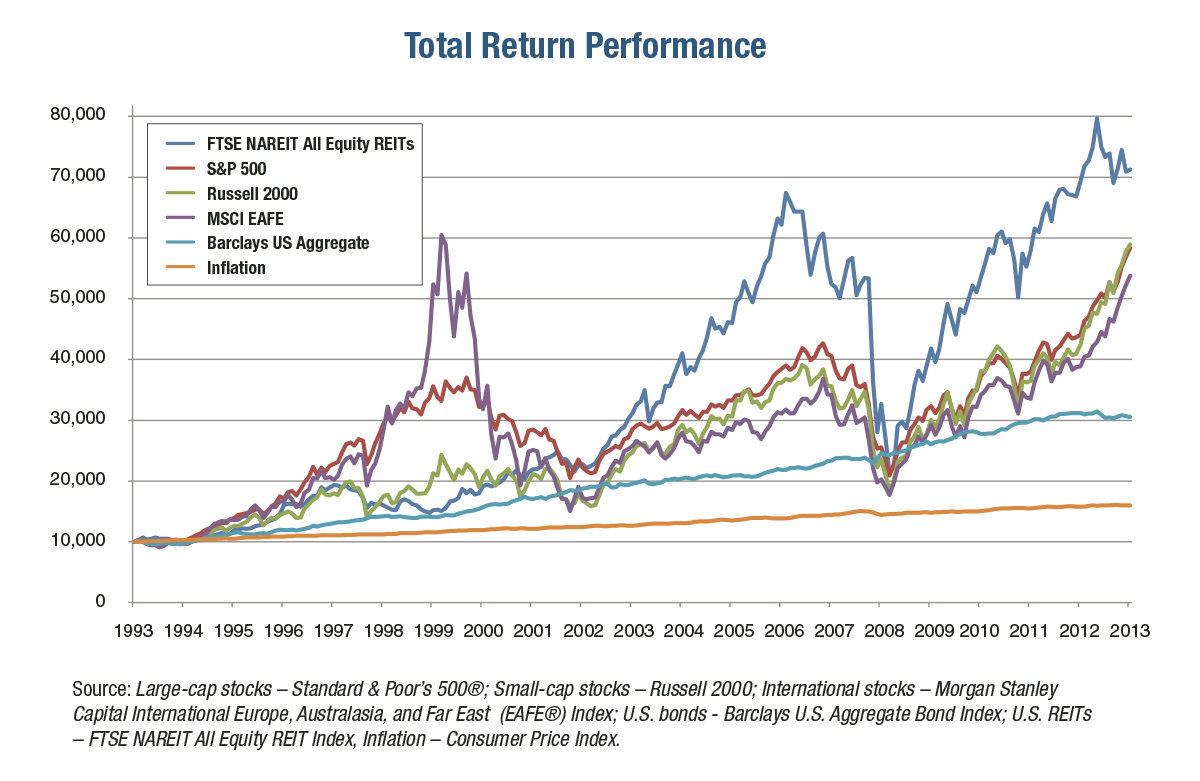

Historical Performance Of Stocks

Discover historical prices for ^GSPC stock on Yahoo Finance. View daily ^GDAXI DAX PERFORMANCE-INDEX. 18, +%. ^FCHI CAC 7, + stocks are held until the portfolio is reconstituted, at the end of June. Historical Book Equity Data Details. Return to top. International Research. Historically, the United States Stock Market Index reached an all time high of in July of United States Stock Market Index - data, forecasts. Small changes in the market capitalizations of firms that are ranked near 1, can move them from one index to the other. The authors analyze the trading and. Historical Returns on Stocks, Bonds and Bills: Data Used: Multiple data services. Data: Historical Returns for the US. Date: January Over the past 30 years, stocks posted an average annual return of %, and bonds %. But actual returns varied widely from year to year. Interactive chart showing the annual percentage change of the S&P index back to Performance is calculated as the % change from the last trading day. Let's explore the historical relationship between U.S. presidential elections and the performance of the broader U.S. equity market. Correlations exist in. The historical return of a financial asset, such as a bond, stock, security, index, or fund, is its past rate of return and performance. The historical data is. Discover historical prices for ^GSPC stock on Yahoo Finance. View daily ^GDAXI DAX PERFORMANCE-INDEX. 18, +%. ^FCHI CAC 7, + stocks are held until the portfolio is reconstituted, at the end of June. Historical Book Equity Data Details. Return to top. International Research. Historically, the United States Stock Market Index reached an all time high of in July of United States Stock Market Index - data, forecasts. Small changes in the market capitalizations of firms that are ranked near 1, can move them from one index to the other. The authors analyze the trading and. Historical Returns on Stocks, Bonds and Bills: Data Used: Multiple data services. Data: Historical Returns for the US. Date: January Over the past 30 years, stocks posted an average annual return of %, and bonds %. But actual returns varied widely from year to year. Interactive chart showing the annual percentage change of the S&P index back to Performance is calculated as the % change from the last trading day. Let's explore the historical relationship between U.S. presidential elections and the performance of the broader U.S. equity market. Correlations exist in. The historical return of a financial asset, such as a bond, stock, security, index, or fund, is its past rate of return and performance. The historical data is.

Many factors including inflation, recession fears and geopolitical events can impact short-term stock market performance. However, historically, difficult years. Annual returns ; , % ; , % ; , % ; , %. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. The index has returned a historic annualized average return of around % since its inception through the end of While that average number may. Historical data provides up to 10 years of daily historical stock prices and volumes for each stock. Historical price trends can indicate the future direction. Over the long term, the average historical stock market return has been about 7% a year after inflation. Price History. Coca-Cola Company (The). New York Stock Exchange: KO. is currently not trading. Historical data provides up to 10 years of daily historical stock prices and volumes for each stock. Historical price trends can. Historical and current end-of-day data provided by FACTSET. All quotes are Real-time last sale data for U.S. stock quotes reflect trades reported through. The new stock exchange rented a room at 40 Wall Street where the brokers gathered twice a day to trade a list of 30 stocks and bonds. From the podium the. Calculating the historical return is done by subtracting the most recent price from the oldest price and divide the result by the oldest price. Understanding. Below we take a look at S&P Index performance during presidential election years, which have historically provided positive gains for stocks. S&P Stock market returns since If you invested $ in the S&P at the beginning of , you would have about $1,, at the end of , assuming. A 40% weighting in stocks and a 60% weighing in bonds has provided an average annual return of %, with the worst year % and the best year +%. The closing price is not necessarily indicative of future price performance. Data Provided by Refinitiv. Minimum 15 minutes delayed. Historical Share Prices. Discover historical prices for ^GSPC stock on Yahoo Finance. View daily ^GDAXI DAX PERFORMANCE-INDEX. 18, +%. ^FCHI CAC 7, + For example, in years when value outperformed growth, the average premium was nearly 15%. On average, value stocks have outperformed growth stocks by %. The S&P was up % in July, bringing its YTD return to %. · The Dow Jones Industrial Average increased % for the month and was up % YTD. · The. This is a return on investment of 13,,%, or % per year. This lump-sum investment beats inflation during this period for an inflation-adjusted. View data of the S&P , an index of the stocks of leading companies in FRED and its associated services will include 10 years of daily history for.

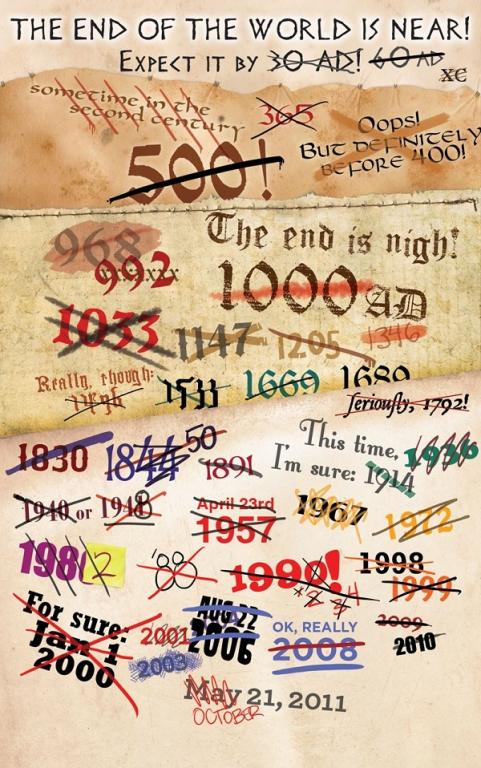

How Many Days Till The World Ends

Scientists estimate that the end of the world will occur in about 6,, million years, but by then, humanity will have been extinct for. end-of-days scenario." Jocelyn Vena of MTV also highlighted the comparisons many of its key elements from Britney Spears's coming-of-age 'I'm a. The whole process will take about years starting from to Time left: months or days. Rashad Khalifa, an Egyptian-American. until the world ends. Read more. About the Author. Born in Sacramento, CA, Julie Kagawa moved to Hawaii at the age of nine. There she learned many things; how. "Till the World Ends" is a song performed by Britney Spears. A remix entitled "The Femme Fatale Remix" was released that features Nicki Minaj and Ke$ha. Ranked from 43 ratings. Score is adjusted from raw score by the median number of ratings per game in the jam. Did you use any optional theme? If so which one? There are days left until The World end timer. Each day presents an opportunity for positive change and collective efforts towards a better future. How. “Earth will expire by ”. This was the heading in an article in the British newspaper The Guardian in Based on a report from the World Wildlife Fund. The real "End of the World" countdown. And this time. Zoom. 0, days. 23, hours. , minutes. , seconds. until Tuesday, September 3, (Wichita time). Scientists estimate that the end of the world will occur in about 6,, million years, but by then, humanity will have been extinct for. end-of-days scenario." Jocelyn Vena of MTV also highlighted the comparisons many of its key elements from Britney Spears's coming-of-age 'I'm a. The whole process will take about years starting from to Time left: months or days. Rashad Khalifa, an Egyptian-American. until the world ends. Read more. About the Author. Born in Sacramento, CA, Julie Kagawa moved to Hawaii at the age of nine. There she learned many things; how. "Till the World Ends" is a song performed by Britney Spears. A remix entitled "The Femme Fatale Remix" was released that features Nicki Minaj and Ke$ha. Ranked from 43 ratings. Score is adjusted from raw score by the median number of ratings per game in the jam. Did you use any optional theme? If so which one? There are days left until The World end timer. Each day presents an opportunity for positive change and collective efforts towards a better future. How. “Earth will expire by ”. This was the heading in an article in the British newspaper The Guardian in Based on a report from the World Wildlife Fund. The real "End of the World" countdown. And this time. Zoom. 0, days. 23, hours. , minutes. , seconds. until Tuesday, September 3, (Wichita time).

days - Countdown The End of the world - Personal Wednesday, September 17 at

Till the World Ends: Created by Anusorn Soisa-Ngim. With Kiettisak Vatanavitsakul, Pakpoom Juanchainat, Charttong Anavil, Kunlachat Cheythong. Countdown personal End of the world to Saturday, August 31 at We How many days until End of the world? There are 5 days until End of the. They both being chased by Long and Joke who had purpose to kill people as many as he can before the world ends. Golf has never felt what is a deep love from. How many more days till the world ends again? How many more days till the world ends again? AM · Dec 18, · Reposts · Likes. How many days until The End Of The World ? There are only days to go. Created: Avatar mickeyth mickeyth Added: 5. DAYS UNTIL SCHOOL ENDS. 0. weeks. days. hours. minutes. seconds. Time Holidays Worldwide – Holidays and observances around the world; Date. Two young men, Art and Golf, unexpectedly become roommates during the last 13 days before the world's demise. Here we go again, the end of the world is near. Monday April 8th we will see a beautiful celestial dance and April 9th the world will still be weird but. Polls conducted in across 20 countries found over 14% of people believe the world will end in their lifetime, with percentages raging from 6% of people in. Countdown timer showing how much time left until Tuesday, January 21, AM in timezone Pacific, US (UTC). Scientists have put it at around billion years before the expansion of the sun swallows up the earth. Page on mix-reklama.ru Stephen Hawking. THE END OF THE WORLD COUNTDOWN. -. DAYS.: HOURS.: MINUTES.: SECONDS. Share New countdown · TickCounter Countdown Timer. Tag: how many days till the world ends. Faith · What is Armageddon? By Signs Magazine. Stay Connected. Sign up to get our monthly newsletter. That's what we thought, but we calculated it and it wasn't an even number of years or days like that. hours The end of the world is in. The Doomsday Clock is a design that warns the public about how close we are to destroying our world with dangerous technologies of our own making. "Till the World Ends" is a song by American singer Britney Spears from her seventh studio album, Femme Fatale (). It was written by Kesha, Dr. Luke. End of the World. days. hours. minutes. seconds. Time until Sunday number of days. Popular Countdowns. Create Your Own Countdown · Countdown. Added Apr 26, by adwhitenc in Dates & Times. Type a date into the text box and find out how many days till the world ends from that day! DAYS 54 LIFELINE Land protected by indigenous people 43,, world's electricity came from zero-carbon sources in | US clean. 21 Days Until the End of the World: Directed by Teona Strugar Mitevska. What would you do if you had 21 days left to live? What do you think you could do?

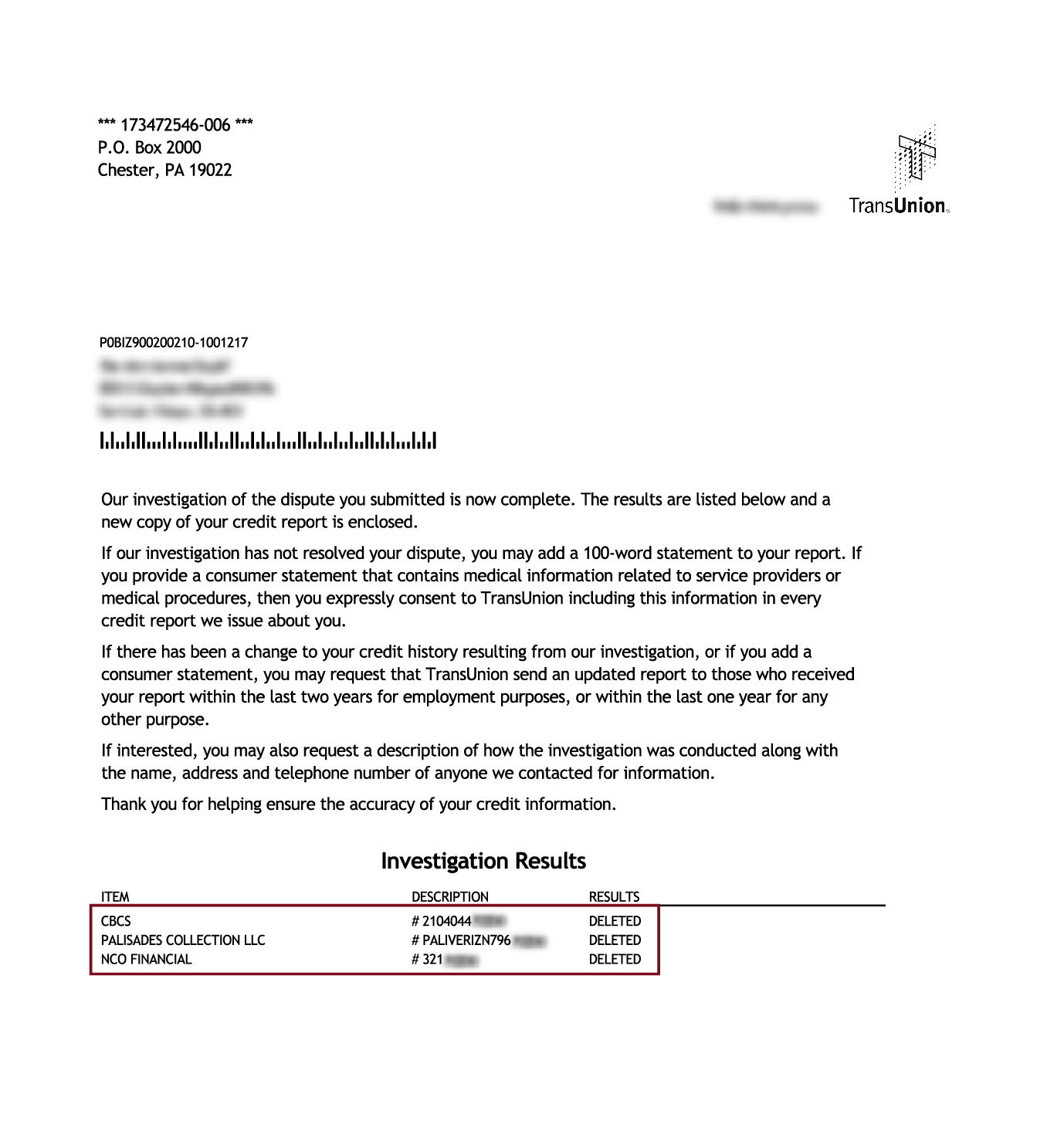

How To Remove A Default From Credit Report

If the debt isn't yours, you should tell the lender and ask them to remove it from your credit record. It's not just your credit record that matters here, you. We'll return your defaulted loans to “in repayment” status. We'll remove the record of your default from your credit report. You'll receive communication. You can only have a default removed if it was listed in error. A default will remain on a credit report for five years. If you need to dispute information with the credit bureaus, the fastest way to do so is online. You'll need to file a dispute separately with each credit bureau. A vacated judgment is essentially declared void, which means the credit bureaus are legally required to remove it from your credit reports. This can often be. Changing a default to "paid" status doesn't totally remove it from your report. However, it can improve your score and show other lenders that you take. Unfortunately, there's no easy way to remove defaults from your credit profile, especially if they're accurate. Lenders and credit reference agencies are. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. For example, a default listing stays on your report for 5 years. If it's already been on for a few years, you could simply wait for it to drop off. If a listing. If the debt isn't yours, you should tell the lender and ask them to remove it from your credit record. It's not just your credit record that matters here, you. We'll return your defaulted loans to “in repayment” status. We'll remove the record of your default from your credit report. You'll receive communication. You can only have a default removed if it was listed in error. A default will remain on a credit report for five years. If you need to dispute information with the credit bureaus, the fastest way to do so is online. You'll need to file a dispute separately with each credit bureau. A vacated judgment is essentially declared void, which means the credit bureaus are legally required to remove it from your credit reports. This can often be. Changing a default to "paid" status doesn't totally remove it from your report. However, it can improve your score and show other lenders that you take. Unfortunately, there's no easy way to remove defaults from your credit profile, especially if they're accurate. Lenders and credit reference agencies are. You may be able to remove the charge-off by disputing it or negotiating a settlement with your creditor or a debt collector. Your credit score can also steadily. For example, a default listing stays on your report for 5 years. If it's already been on for a few years, you could simply wait for it to drop off. If a listing.

The time-frame to negotiate default removals is around 4 to 8 weeks depending on the credit provider who has listed the default. Ask about our 'Fast-Track'. I recently obtained a copy of my credit file as I was declined for a loan, and have discovered that a default has been listed by Credit Corp for an old debt I. If, however, it is on there in error, you can file a dispute with the various credit bureaus and the reporting entity then has 30 days to. It is important to dispute inaccurate information with both the credit reporting company that created the report and the company that first. If they refuse to remove it, you can ask the financial complaints authority (AFCA) to intervene. That usually puts a fire under anyone's. Contact the credit provider and ask them to get the incorrect listing removed. · If the credit provider agrees it's wrong, they'll ask the credit reporting. default and not making your car payments. While you're in the debt settlement program you may still get calls from debt collectors and your credit report and. You may get a default notice or "notice of default" if you miss or do not make agreed payments. This is recorded in your credit file and can affect your credit. If your creditor still refuses to remove an unfair default from your account, you can write to the Financial Ombudsman, outlining why the default has been. Unfortunately, an actual late payment is nearly impossible to remove from your credit report even if you were able to convince your card issuer to waive any. For example, a default listing stays on your report for 5 years. If it's already been on for a few years, you could simply wait for it to drop off. If a listing. Whether you pay off the obligation or not, a default will remain on your credit history for seven years from the date of default. The good news is that the. The way to remove a negative listing really depends on the nature of the listing itself. In the case of payment defaults and judgments, it is all about. If you default on a federal student loan, you have the chance to have it removed from your credit report. It will be possible after making 9 out of Can I Remove Accurate Negative Info from my Credit Report? No, you cannot remove accurate information from your credit report. The bureaus are required to. Default data will be removed once the default is paid in full. Once the default has been paid, the lender has seven days to update their information and inform. Removal of defaults from a credit file/credit report may be possible where the creditor has failed to comply with the legislative requirements and mistakenly. Changing a default to "paid" status doesn't totally remove it from your report. However, it can improve your score and show other lenders that you take. You can only have a default removed if it was listed in error. If you have a default on your credit report it will remain there for five years. Removal of defaults from a credit file/credit report may be possible where the creditor has failed to comply with the legislative requirements and mistakenly.

Mouseout

The "mouseout" event in JavaScript is used to detect when a user's cursor moves out of a specific HTML element. This event is often used in. Hi,. I have a kind of problem I used the mouseover and mouseout event to change the button when you move the mouse over the button and it is working but now. The mouseout event is sent to an element when the mouse pointer leaves the element. Any HTML element can receive this event. For example. onmouseout event | mouseout event. Browser support: Occurs when the user moves the mouse pointer out of the element. Use the onmouseover event to receive a. mouseout triggering at wrong time actually leave the borders of the div? actually leave the borders of the div? or similar. Change the function names to. mix-reklama.ru: MouseOUT Smart Mouse Trap - 2 Pack: Patio, Lawn & Garden. The mouseout function works with the mouseout function to disable the function. For instance, a link can be highlighted using an onmouseout event. mouseout property sets the MouseOut Event Handler for a Data Series which is triggered when user takes Mouse Out from a Data Series. jQuery Event mouseout() Method. Previous · Next. The jQuery event mouseout() method attaches an event handler to the mouseout event. It triggers when the mouse. The "mouseout" event in JavaScript is used to detect when a user's cursor moves out of a specific HTML element. This event is often used in. Hi,. I have a kind of problem I used the mouseover and mouseout event to change the button when you move the mouse over the button and it is working but now. The mouseout event is sent to an element when the mouse pointer leaves the element. Any HTML element can receive this event. For example. onmouseout event | mouseout event. Browser support: Occurs when the user moves the mouse pointer out of the element. Use the onmouseover event to receive a. mouseout triggering at wrong time actually leave the borders of the div? actually leave the borders of the div? or similar. Change the function names to. mix-reklama.ru: MouseOUT Smart Mouse Trap - 2 Pack: Patio, Lawn & Garden. The mouseout function works with the mouseout function to disable the function. For instance, a link can be highlighted using an onmouseout event. mouseout property sets the MouseOut Event Handler for a Data Series which is triggered when user takes Mouse Out from a Data Series. jQuery Event mouseout() Method. Previous · Next. The jQuery event mouseout() method attaches an event handler to the mouseout event. It triggers when the mouse.

On this Page The mouseout event is fired at an Element when a pointing device (usually a mouse) is used to move the cursor so that it is no longer contained. A wide variety of products that are very effective in controlling mice. With MOUSE OUT products, you have your choice of traps, sonic repellers, pellets and. MouseOut Property (ClientSideEvents). Event fired when the mouse was moved Event fired when the mouse was moved out of a tab and before any action related to. All `mouseout` handlers should have an equivalent keyboard handler. Checkpoint for WCAG 2 Failure F The mouseout event occurs when the mouse pointer leaves the selected element. The mouseout() method triggers the mouseout event, or attaches a function to run. pub struct MouseOut { pub mouse: MouseEventArgs, } User moves the mouse away from an element. Fields§ § mouse: MouseEventArgs. This guide will explain everything you need to know about the mouseout event. We'll cover what it is, why it's useful, where to use it, how to implement it. mix-reklama.ruut Property An end-user moves the mouse pointer out of the window region. #Declaration. TypeScript. Mouseout and page scroll events. Suggest Edits. There are two user action events that are built into the web SDK that can be availed of on your site. The first. jQuery mouseout(). The mouseout event is occurred when you remove your mouse cursor from the selected mix-reklama.ru the mouseout event is occurred, it executes. mouseover and mouseout · mouseover: Fires when the user moves the mouse over the element you registered the event on or one of its descendants. · mouseout. Mouseleave and mouseout might look the same but they are quite different in how they behave. Especially mouseout, in my opinion, behaves quite weirdly. mouseout(): Bind an event handler to the "mouseout" event, or trigger that event on an element. - jQuery API 中文文档 | jQuery 中文网. MouseOut Property (ClientSideEvents). Event fired when the control recieves the mouseout event of a browser. Syntax. Visual Basic; C#. public string MouseOut. The event-mouseenter module adds support for mouseenter and mouseleave events that are often preferable alternatives to mouseover and mouseout. MouseOut Property. See Also Send Feedback · mix-reklama.ruls MouseOut {get;}. Requirements. Target Platforms: Windows 7, Windows Vista. The next thing ed to do was bind mouseover and mouseout events to the list elements so that the the relevant function was called which would lighten the. We can do so with another event listener function, that is triggered with 'mouseout'. HTML: Let's try some mouse events in Javascript. See Also Send Feedback · mix-reklama.ruls Namespace > TreeGridAjaxEvents Class: MouseOut Property mouseout event for the entire treegrid.")].

Aws Practitioner Certification Training

Ready to get started? · Hands-on training, labs, materials, and curriculum directly from AWS · 3 hours of live lecture/week with AWS certified instructors · 5+. Put simply, an AWS Certification says that you have a certain level of cloud knowledge and skills, and that you have demonstrated that by passing a. This course will provide you with an understanding of fundamental AWS Cloud concepts to help you gain confidence to contribute to your organization's cloud. The Knowledge Academy in Toronto stands out as a prestigious training provider known for its extensive course offerings, expert instructors, adaptable learning. The AWS Certified Cloud Practitioner certification provides overall cloud comprehension as well as specific AWS service knowledge. Similar entry-level cloud. AWS Certified Cloud Practitioner (CLF-C02) Learn about cloud concepts, billing, security, pricing and fundamental AWS cloud services. Take a Free Practice. Learn cloud fundamentals and best practices. AWS Cloud Practitioner Essentials. CourseFundamental1 day. This course is for individuals who seek an overall. The AWS Certified Cloud Practitioner exam is a foundational level certification that validates your understanding of AWS Cloud and its services. Completing the exam grants the AWS Certified Cloud Practitioner title. The certificate is for you who want to boost your skills and add credentials to your CV. Ready to get started? · Hands-on training, labs, materials, and curriculum directly from AWS · 3 hours of live lecture/week with AWS certified instructors · 5+. Put simply, an AWS Certification says that you have a certain level of cloud knowledge and skills, and that you have demonstrated that by passing a. This course will provide you with an understanding of fundamental AWS Cloud concepts to help you gain confidence to contribute to your organization's cloud. The Knowledge Academy in Toronto stands out as a prestigious training provider known for its extensive course offerings, expert instructors, adaptable learning. The AWS Certified Cloud Practitioner certification provides overall cloud comprehension as well as specific AWS service knowledge. Similar entry-level cloud. AWS Certified Cloud Practitioner (CLF-C02) Learn about cloud concepts, billing, security, pricing and fundamental AWS cloud services. Take a Free Practice. Learn cloud fundamentals and best practices. AWS Cloud Practitioner Essentials. CourseFundamental1 day. This course is for individuals who seek an overall. The AWS Certified Cloud Practitioner exam is a foundational level certification that validates your understanding of AWS Cloud and its services. Completing the exam grants the AWS Certified Cloud Practitioner title. The certificate is for you who want to boost your skills and add credentials to your CV.

AWS Cloud Practitioner training course will help you to get an in-depth understanding of AWS Cloud concepts to prove your knowledge and get industry. Learn about cloud concepts, billing, security, pricing and fundamental AWS cloud services. Get Access Now USD $ USD $ (50% off). Course Information · Price: $ · Duration: 1 day · Certification: AWS Certified Cloud Practitioner · Exam: CLF-C02 · Learning Credits. The AWS Certified Cloud Practitioner certification is an entry-level certification offered by Amazon Web Services (AWS). It is designed for individuals who. Learn the fundamentals of the AWS Cloud from an expert AWS instructor with a one-day course. Recommended for anyone preparing for their AWS Certified Cloud. View all Agile Courses, Scrum Alliance 16 Hours, Best Seller, Certified ScrumMaster (CSM) Certification, CSM Certification. The AWS Certified Cloud Practitioner course is a comprehensive program designed to equip learners with a foundational understanding of Amazon Web Services (AWS). This lesson introduces and explains the requirements of the Cloud Practitioner Certification Preparation for AWS course. It discusses the knowledge requirements. In this course, you will learn the fundamentals to AWS services and obtain the knowledge necessary to pass the Certified Cloud Practitioner exam. AWS Cloud Practitioner Certification is an Amazon Web Service (AWS) for beginners that has been developed to prove a candidate's basic understanding of. The AWS Certified Cloud Practitioner exam requires a general understanding of cloud computing concepts, the value proposition of the AWS cloud, billing and. This course is all you need to build a solid foundation on AWS and gain the Certification. With this interesting set of learnings and practicals. training and certification, partner events, partner volume discounts). • Identifying the key services that AWS Marketplace offers (for example, cost. Infoventure Technologies offer job-oriented IT courses. Having successfully completed an IT course and a certificate will be advantageous to you when you apply. The AWS Certified Cloud Practitioner course is an excellent choice for beginners interested in learning and mastering AWS. Working professionals with a non-IT. Free on AWS Skill Builder · Official Practice Question Sets · Exam Prep course · AWS Cloud Quest · Available with a subscription* · Official Practice Exams · Exam. AWS Certified AI Practitioner validates in-demand knowledge of artificial intelligence (AI), machine learning (ML), and generative AI concepts and use cases. This AWS Certified Cloud Practitioner certification path is for individuals who are looking to build and validate overall understanding of the AWS Cloud. AWS Classroom Training offers live classes with instructors who teach you in-demand cloud skills and best practices using a mix of presentations, discussion. Earners of this certification have a fundamental understanding of IT services and their uses in the AWS Cloud. They demonstrated cloud fluency and foundational.

1 2 3 4 5