mix-reklama.ru

News

Western Union Vs Paypal

Here we compare three major players — MoneyGram vs. Western Union vs. PayPal — to see which one offers the better deal. You can compare prices, gauge costs, and make sure a money transfer with Western Union is right for you. Send money on the go with our app. From Toronto to. With PayPal, you can transfer funds with just a few clicks, while Western Union requires you to physically visit a location. Enjoy a $0 transfer fee* on your first transfer with Western Union®. Send money, track transfers, view exchange rates**, and find agent locations across. Western Union makes money from fx. Offer not available for When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Compare PayPal vs. Paysend vs. Stripe vs. Western Union using this comparison chart. Compare price, features, and reviews of the software side-by-side to. PayPal may offer a better exchange rate and fast transfer speeds. We compare Western Union and PayPal to help you pick the best option for your transfer. Xoom and Western Union both offer viable money transfer options. Xoom is more limited than Western Union, in terms of recipients, locations, and transfer. Our Western Union vs PayPal comparison has found that Western Union offers faster transfer times, more favourable exchange rates, and lower fees than PayPal. Here we compare three major players — MoneyGram vs. Western Union vs. PayPal — to see which one offers the better deal. You can compare prices, gauge costs, and make sure a money transfer with Western Union is right for you. Send money on the go with our app. From Toronto to. With PayPal, you can transfer funds with just a few clicks, while Western Union requires you to physically visit a location. Enjoy a $0 transfer fee* on your first transfer with Western Union®. Send money, track transfers, view exchange rates**, and find agent locations across. Western Union makes money from fx. Offer not available for When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Compare PayPal vs. Paysend vs. Stripe vs. Western Union using this comparison chart. Compare price, features, and reviews of the software side-by-side to. PayPal may offer a better exchange rate and fast transfer speeds. We compare Western Union and PayPal to help you pick the best option for your transfer. Xoom and Western Union both offer viable money transfer options. Xoom is more limited than Western Union, in terms of recipients, locations, and transfer. Our Western Union vs PayPal comparison has found that Western Union offers faster transfer times, more favourable exchange rates, and lower fees than PayPal.

In addition to the transfer fee, Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees. PayPal rates % higher than Western Union on Leadership Culture Ratings vs Western Union Ratings based on looking at ratings from employees of the two. Fees. The fees are what a bank or company such as Western Union or PayPal will charge you to send money outside of the U.S. The fee is typically a. It's cheaper and faster than Western Union or any other bank transfer service online. A PayPal wire transfer is still one of the quickest and most trusted ways. Compare PayPal vs Western Union. Wise uses the REAL exchange rate and charges a low, transparent fee. Ria is not far behind with /5 from 13k+ reviews, and Western Union is also doing well with 4/5 from 57k reviews. Ria, MoneyGram, WesternUnion. 🏛️Established. Western Union Settlement Continues to Return Money to People Who Paid Scammers Using Western Union. The Justice Department is sending payments totaling nearly. Xoom and Western Union both offer viable money transfer options. Xoom is more limited than Western Union, in terms of recipients, locations, and transfer. New apps like PayPal and Zelle make it easy to send money to friends and family in a matter of minutes, with no fees. Western Union and MoneyGram can be. In summary, PayPal is more suitable for online payments and transfers, while Western Union is better for international transfers with cash pickup options. It's. PayPal is more secure as the currency being transferred is all electronic and can go directly to your bank. Western Union is for those who wish to get the. Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees. Send money instantly with a debit card with a debit card or credit card2, or with your bank account. 5. Confirm, send and track your transfer. Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees. Enjoy a $0 transfer fee* on your first transfer with Western Union®. Send money fast to Mexico and globally from the US, available 24/7. Western Union may offer better rates than conventional banks when it comes to international money transfers, but by no means is it the industry leader in this. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. not match PayPal. Please check your PayPal account and enter the. Which is cheaper, Western Union or Xoom? ; Payment Method. Xoom Fees in USD. WU Fees in USD ; Bank account. ; PayPal balance. N/A ; Debit card. PayPal is not one of the pay-in methods available on the Western Union platform. This means that to fund your Western Union transfer using your PayPal balance. Traditional banks, Western Union, and digital platforms like PayPal have limitations in fees, speed, and global reach. Alternatives like the money transfer.

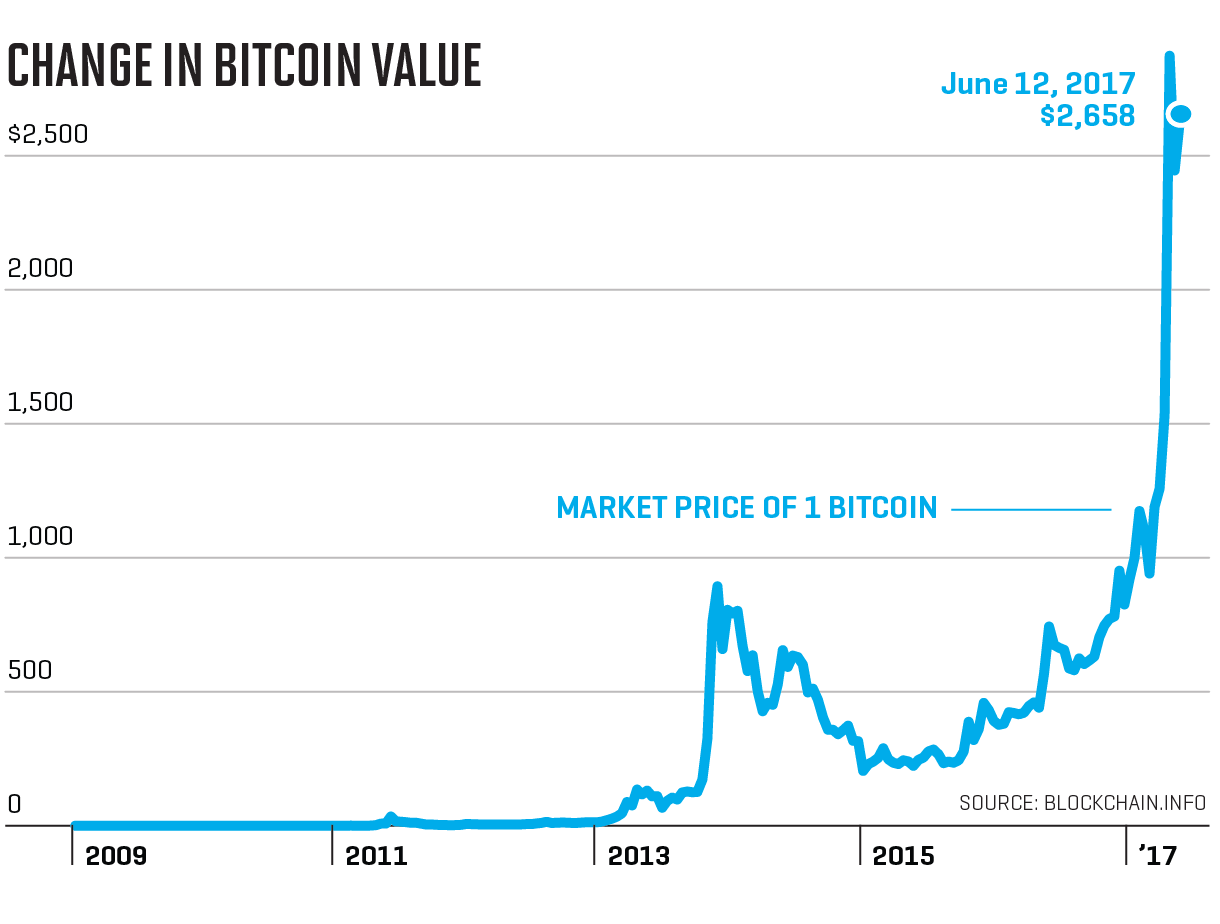

Bit Coin Value By Year

Bitcoin Market Cap is at a current level of T, up from T yesterday and up from B one year ago. This is a change of % from yesterday and. However, during the first few years of BTC's existence, the competition between What Is Bitcoin's Role as a Store of Value? Bitcoin is the first. Discover historical prices for BTC-USD stock on Yahoo Finance. View daily, weekly or monthly format back to when Bitcoin USD stock was issued. It had no monetary value. When Satoshi mined the genesis block (first block), 50 BTC went into circulation at $0. Fast forward to November 10, , 12 years. Live Bitcoin price (BTC) including charts, trades and more. Create real-time notifications and alerts to follow any changes in the Bitcoin value 1 Year; 5. One bitcoin was worth approximately 17, euros at that time. Some facts about the bitcoin price throughout the years: The bitcoin price has increased. In January, Bitcoin was trading at a low value of $16,; it peaked in July at $31,, with a market capitalization of around $ billion. The stubborn. BTC reached a value of USD$ for the first time ever. From the agonizing March crash to the parabolic move into the end of the year, was a year of. Bitcoin news, USD price, real-time (live) charts. Learn about BTC value, bitcoin cryptocurrency, crypto trading, and more. Bitcoin Market Cap is at a current level of T, up from T yesterday and up from B one year ago. This is a change of % from yesterday and. However, during the first few years of BTC's existence, the competition between What Is Bitcoin's Role as a Store of Value? Bitcoin is the first. Discover historical prices for BTC-USD stock on Yahoo Finance. View daily, weekly or monthly format back to when Bitcoin USD stock was issued. It had no monetary value. When Satoshi mined the genesis block (first block), 50 BTC went into circulation at $0. Fast forward to November 10, , 12 years. Live Bitcoin price (BTC) including charts, trades and more. Create real-time notifications and alerts to follow any changes in the Bitcoin value 1 Year; 5. One bitcoin was worth approximately 17, euros at that time. Some facts about the bitcoin price throughout the years: The bitcoin price has increased. In January, Bitcoin was trading at a low value of $16,; it peaked in July at $31,, with a market capitalization of around $ billion. The stubborn. BTC reached a value of USD$ for the first time ever. From the agonizing March crash to the parabolic move into the end of the year, was a year of. Bitcoin news, USD price, real-time (live) charts. Learn about BTC value, bitcoin cryptocurrency, crypto trading, and more.

After years of analysis of the Bitcoin price, crypto experts are ready to provide their BTC cost estimation for It will be traded for at least $1,, The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time. Any Bitcoin chart showing the BTC exchange rate over time will record that the cryptocurrency languished for three years before embarking upon a bull run in. The highest price of BTC in the last year was $73, and the lowest price of Bitcoin in the last year was $26, 24h. %. In depth view into Bitcoin Price including historical data from to , charts and stats Value from 1 Year Ago, Change from 1 Year Ago, %. The best estimates, IMO, are those that look at BTC's value with respect to gold. That is, BTC will encroach about gold as a store of value, and. Based on a free market ideology, bitcoin was invented in by Satoshi Nakamoto, an unknown person. Use of bitcoin as a currency began in , with the. Price Performance ; 6-Month. 49, +%. on 08/05/24 ; YTD. 38, +%. on 01/23/24 ; Week. 25, +%. on 09/13/23 ; 2-Year. 15, +. Jurrien Timmer, Director of Global Macro at Fidelity Investments, thinks the value of a single Bitcoin could reach $1 billion by the year — Chamath. Get the latest price, news, live charts, and market trends about Bitcoin. The current price of Bitcoin in United States is $ per (BTC / USD). Prices and value history ; 7 December , $3, Decrease. Price briefly dipped below $3,, a 76% drop from the previous year and a month low. ; 1 July. year, according to Trading Economics global macro models projections and analysts expectations. Exchange Rates · BTC Base · USD Base · BTC Quote · USD Quote. The lowest price paid for Bitcoin (BTC) is $, which was recorded on Jul 06, (about 11 years). Comparatively, the current price. Bitcoin launched in with a value of US$0. · However, BTC would go on to hit the US$ mark just four years later. · On the other hand, BTC has had its fair. Get the latest Bitcoin (BTC / USD) real-time quote, historical performance Value of the base currency compared to the quote currency. copyright. Bitcoin price has risen by % over the last week, its month performance shows a % increase, and as for the last year, Bitcoin has increased by %. January 1, , marked the beginning of Bitcoin's sustained price rise. It started the year at US$ and ended it at US$ — a percent value increase in. Bitcoin EUR (BTC-EUR) ; May 24, , 63,, 64, ; May 23, , 64,, 65, ; May 22, , 65,, 66, ; May 21, , 60, Check out the current Bitcoin (BTC) Bitcoin can be traded 24 hours a day, days a year, including weekends and holidays (excludes maintenance times). As the world's first cryptocurrency, Bitcoin has come a long way in terms of its value. Bitcoin halving occurs approximately every four years, where.

Core Stocks For Portfolio

What is the Core Growth portfolio? The Core Growth portfolio is a higher risk portfolio that is invested mainly in stock ETFs. These ETFs collectively invest in. The KAR Small Cap Core Portfolio is a domestic small-cap portfolio that invests in high-quality companies purchased at attractive valuations. iShares Core ETFs are quality, low-cost and tax efficient tools to build a strong portfolio foundation with broad exposures across stocks and bonds. The iShares Core S&P Total U.S. Stock Market ETF seeks to track the investment results of a broad-based index composed of U.S. equities. The truth is, investing is hard, and building a portfolio of top stocks to That's mainly because investors tend to buy stocks or funds during market. Custom Core is a passive portfolio of stocks that adheres to a client-chosen benchmark, delivered as a separately managed account (SMA). With SMAs clients. Morningstar uses the following components and prescribes weights to determine whether a stock (or mutual fund) should reside within the Growth, Value or Core. Berkshire Hathaway ; Apple Inc. Apple ; American Express Co. American Express ; Bank Of America Corp. Bank Of America ; +. 33 more stocks. Built to help you reach your goals. We'll build a diversified portfolio with investments that are handpicked by our team of experts and that seek to provide. What is the Core Growth portfolio? The Core Growth portfolio is a higher risk portfolio that is invested mainly in stock ETFs. These ETFs collectively invest in. The KAR Small Cap Core Portfolio is a domestic small-cap portfolio that invests in high-quality companies purchased at attractive valuations. iShares Core ETFs are quality, low-cost and tax efficient tools to build a strong portfolio foundation with broad exposures across stocks and bonds. The iShares Core S&P Total U.S. Stock Market ETF seeks to track the investment results of a broad-based index composed of U.S. equities. The truth is, investing is hard, and building a portfolio of top stocks to That's mainly because investors tend to buy stocks or funds during market. Custom Core is a passive portfolio of stocks that adheres to a client-chosen benchmark, delivered as a separately managed account (SMA). With SMAs clients. Morningstar uses the following components and prescribes weights to determine whether a stock (or mutual fund) should reside within the Growth, Value or Core. Berkshire Hathaway ; Apple Inc. Apple ; American Express Co. American Express ; Bank Of America Corp. Bank Of America ; +. 33 more stocks. Built to help you reach your goals. We'll build a diversified portfolio with investments that are handpicked by our team of experts and that seek to provide.

Make investing easier with Core Portfolios. Morgan Stanley has joined with E*TRADE to present Core Portfolios, an automated, digital investing platform—also. Investment Overview. The Fund seeks to generate attractive risk-adjusted long-term returns by investing in the stocks of U.S. small-cap companies with. Target Risk Portfolios are a diversified mix of stocks, bonds, cash and other investments. These include options like the ESG Core Equity Portfolio, which. Usually experts suggest no more than 10 to 15 stocks & 3 to 4 ETF's. SPY, QQQ, VGT are good ones. You can also look at buying 10 % of a 2X. The Betterment Core Portfolio is well-diversified, low-cost, and designed to generate long-term returns while reducing risk through diversification. companies whose stocks are selling at substantial discounts to their underlying value. Jeff Kripke. Senior Vice President Portfolio Manager. Biography. Craig. iShares Core Equity ETF Portfolio · NAV as of Aug 26, CAD 52 WK: - · 1 Day NAV Change as of Aug 26, (%) · NAV Total Return. Core-satellite investing is designed to outperform the market with a mix of passive and active investments that reduce the portfolio's cost and risk. Source: Morningstar®. The style box reveals a fund's investment style. The vertical axis shows the market capitalization of the stocks owned and the horizontal. Emerging Markets Core Equity Fund (EUR, Acc.) Inception Date. 01/12/ NAV Value Portfolio III, Emerging Markets Portfolio II. Prior to February. WEIGHTED AVERAGE EXPENSE RATIO% ; iShares Core S&P Mid-Cap ETF. IJHMid Cap. Expense Ratio. %. Weight. %. Dollar amount. -. Number of Shares. -. This strategy offered broad stock, bond, and real estate exposure utilizing only four index funds. The concept proved to be robust and found wide acceptance. Provides investors with broad exposure to large capitalization stocks. Employs a passively managed, low-cost index approach with a fully transparent portfolio. The truth is, investing is hard, and building a portfolio of top stocks to That's mainly because investors tend to buy stocks or funds during market. Eagle Asset Management's Large Cap Core program combines an aggressive stock-selection model with a disciplined approach to portfolio construction and trading. That's why our simplified suite of 24 low-cost SPDR® Portfolio ETFsTM make it easy to build a diversified core portfolio that helps you keep more of what you. CORE PORTFOLIO STOCKS · 1. Tips Industries, , , , , , , , , , , , · 2. Shilchar Tech. Core Portfolios is an advisory program professionally managed by Morgan Stanley Smith Barney LLC (otherwise known as “Morgan Stanley Wealth Management” or “. Stocks are often a riskier investment than bonds, but they also have the potential to generate higher returns. Bonds. When you buy a bond, you're loaning money. Key criteria for companies in the portfolio · Simple, predictable, free cash flow generator · Good ROI and good capital allocator · Not reliant on outside.

How Bad Is A Bankruptcy On Your Credit

Bankruptcy can stay on your credit report for either seven or 10 years, depending on what type of bankruptcy it is. Bankruptcy can do severe damage to your credit score and should be considered a last resort. As an alternative, you may be able to negotiate with your creditors. An important consequence of bankruptcy is its effect on your credit rating. Your credit rating is a record of your credit history maintained by credit bureaus. If you have filed for Chapter 7 bankruptcy, once the bankruptcy court grants a discharge, all of the debts that were included in the bankruptcy will reflect. The law states that credit reporting agencies may not report a bankruptcy case on a person's credit report after ten (10) years from the date the bankruptcy. How Does Bankruptcy Affect My Credit Score? When you file bankruptcy, your credit scores can be negatively impacted almost right away. In fact, many consider. PART FACT/PART FICTION – When you declare personal bankruptcy each of your credit accounts gets an R9 rating, the worst there is. With a non-bankruptcy option. It generally takes months before your credit improves after bankruptcy. FindLaw reviews what you need to know, how to improve your credit score. A bankruptcy can have serious impacts on your credit score, and can hinder your ability to secure credit in the future. That's why it's important to understand. Bankruptcy can stay on your credit report for either seven or 10 years, depending on what type of bankruptcy it is. Bankruptcy can do severe damage to your credit score and should be considered a last resort. As an alternative, you may be able to negotiate with your creditors. An important consequence of bankruptcy is its effect on your credit rating. Your credit rating is a record of your credit history maintained by credit bureaus. If you have filed for Chapter 7 bankruptcy, once the bankruptcy court grants a discharge, all of the debts that were included in the bankruptcy will reflect. The law states that credit reporting agencies may not report a bankruptcy case on a person's credit report after ten (10) years from the date the bankruptcy. How Does Bankruptcy Affect My Credit Score? When you file bankruptcy, your credit scores can be negatively impacted almost right away. In fact, many consider. PART FACT/PART FICTION – When you declare personal bankruptcy each of your credit accounts gets an R9 rating, the worst there is. With a non-bankruptcy option. It generally takes months before your credit improves after bankruptcy. FindLaw reviews what you need to know, how to improve your credit score. A bankruptcy can have serious impacts on your credit score, and can hinder your ability to secure credit in the future. That's why it's important to understand.

The law states that credit reporting agencies may not report a bankruptcy case on a person's credit report after ten (10) years from the date the bankruptcy. How Long Does Bankruptcy in Florida Affect Your Credit? Yes, bankruptcies are recorded on your credit report. Depending on the type of bankruptcy case, it can. After you have been discharged from bankruptcy, the most important thing you can do if you want to get a loan, a mortgage or other credit is to start. A bankruptcy can show that you are at a higher risk of defaulting on your repayments and can make it very difficult to obtain credit or to even open a new bank. A first bankruptcy will remain on your credit report for six years after discharge. This is extended to 14 years for a second bankruptcy. The real impact of bankruptcy on your credit score may surprise you. Credits scores often improve an average of 80 points immediately after bankruptcy. Although the exact impact can vary, a bankruptcy will generally hurt credit scores. Credit scores help tell creditors the likelihood that borrowers will. Bankruptcy stays on your credit file for at least six years. This can make it hard to get credit, loans or a mortgage. The rules around debt relief orders (DRO). Many people worry that filing bankruptcy will severely impact their credit, and they are right in the sense that Chapter 7 bankruptcy can negatively affect your. Even though filing bankruptcy remains on your credit report for years, it doesn't impact your ability to obtain credit that entire time as long as you can. This means your bankruptcy could drop your credit score into the range—numbers which are very hard to recover from. When your credit score drops that. Filing bankruptcy can cause your credit score to drop dramatically. If a lender is willing to accept your credit application despite your low score, it is. Ignoring those debts will not improve your credit score. Life after bankruptcy provides you with an opportunity to begin the process of repairing your credit. It is true that filing for bankruptcy lowers your credit rating quite far. Because credit rating is different for everyone, I cannot say by how many points a. So your credit score and the impact bankruptcy has to your credit score really depends on various factors. There is a common incorrect belief. Most people who file for bankruptcy will find that their credit score is actually higher than it was one to two years after filing. In the short run, bankruptcy will significantly lower your credit score and prevent you from getting credit on favorable terms. If you had good credit before bankruptcy, your credit score will drop a lot more. This is because you were good at managing money before, so bankruptcy will. Bankruptcy is likely to drop your credit score to the lowest possible rating at most Canadian credit bureaus. That means lenders, insurers, landlords, employers.

Borrowed Capital

![]()

1. A domestic stock or mutual insurer may borrow money to defray the expenses of its organization, provide it with surplus funds or for any purpose of its. Investment funds, • Investment property, • Private equity, Realistic sets of financial statements – for existing IFRS. Borrowed capital refers to the capital that a company raises from external sources to finance its operations. Debt capital is capital that has been raised through borrowing from a source outside the company. Lisa can offer debentures to investors to raise money. A. Merrill and Bank of America offers borrowing options, such as mortgages, lines of credit, custom lending, and auto loans for your personal and business. They use their own capital, plus funds borrowed with an SBA guarantee, to make equity and debt investments in qualifying small businesses. Learn more about. Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital. Define borrowed capital. means the total loans, deposits and other borrowings of a co- operative society including the debentures subscribed and paid up;. Borrowed capital is capital that the business borrows from institutions or people, and includes debentures: Redeemable debentures · Irredeemable debentures. 1. A domestic stock or mutual insurer may borrow money to defray the expenses of its organization, provide it with surplus funds or for any purpose of its. Investment funds, • Investment property, • Private equity, Realistic sets of financial statements – for existing IFRS. Borrowed capital refers to the capital that a company raises from external sources to finance its operations. Debt capital is capital that has been raised through borrowing from a source outside the company. Lisa can offer debentures to investors to raise money. A. Merrill and Bank of America offers borrowing options, such as mortgages, lines of credit, custom lending, and auto loans for your personal and business. They use their own capital, plus funds borrowed with an SBA guarantee, to make equity and debt investments in qualifying small businesses. Learn more about. Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital. Define borrowed capital. means the total loans, deposits and other borrowings of a co- operative society including the debentures subscribed and paid up;. Borrowed capital is capital that the business borrows from institutions or people, and includes debentures: Redeemable debentures · Irredeemable debentures.

Who funds the IMF? · MEMBER QUOTAS · NEW ARRANGEMENTS TO BORROW · BILATERAL BORROWING AGREEMENTS. Cash flows from capital and related financing activities include acquiring and disposing of capital assets, borrowing money to acquire, construct or improve. Consider an investment project that requires capital cost of $1,, to purchase a machine at time zero, which yields the annual revenue of $, and. Borrowed capital. Borrowed capital. The KNOX team has not only a wealth of experience in procuring equity but also long years of experience in company. This term refers to money that is borrowed and then invested in the financial market. This capital can be obtained from different sources, including banks. Leverage Risk. The Weight of Borrowed Capital Distinguishes the Solvency of Firms: An Empirical Analysis on a Sample of Italian SMEs. Owned capital and borrowed capital are two types of capital that a business can use to finance its operations and growth. Another way to say Borrowed Capital? Synonyms for Borrowed Capital (other words and phrases for Borrowed Capital). capital purpose undertaking fund for the current school fiscal year and the borrowed and issued notes pursuant to this section in either the. Borrowed capital. (1) A domestic mutual insurer may, with the commissioner's advance approval and without the pledge of any of its assets, borrow money to. Borrowed capital means all indebtedness of a corporation, subject to the provisions of this Chapter, maturing more than one year from the date incurred. Borrowed Funds Secured by an Asset. Borrowed funds secured by an asset are an acceptable source of funds for the down payment, closing costs, and reserves. Below is an illustration of two common leverage ratios: debt/equity and debt/capital. Using borrowed funds, instead of equity funds, can really improve the. Borrowed capital consists of money that is borrowed and used to make an investment. So, the house, which is now an asset belonging to the homeowner. borrowed but tend to be lower than unsecured lending options such as credit cards. When to use it: Funds borrowed on margin are usually used for: Additional. Deposits / Borrowed Funds. Deposits/borrowed funds, liquidity management, and funds management are integrally related. It is recommended that Handbook. capital intensive, requiring large amounts of capital. Debt financing involves borrowing funds from creditors with the stipulation of repaying the borrowed. Shmoop's Finance Glossary defines Borrowed Capital in relatable, easy-to-understand language. capital intensive, requiring large amounts of capital. Debt financing involves borrowing funds from creditors with the stipulation of repaying the borrowed.

2 3 4 5 6